I just noticed with pleasure that Martin Sandbu, whose work I much admire, has posted a response to a thread of posts between me and Matthew Klein. Here in chronological order:

Me: Why Economists Don’t Know How to Think about Wealth (or Profits)

Matthew: The virtues and pitfalls of putting capital gains into the national accounts

Me: Wealth and the National Accounts: Response to Matthew Klein

And…

Martin: You’re not as rich as you think

Beware of treating pseudo-wealth as the real thing

I’ll start with Martin’s conclusion (emphasis mine), and reply to some of his particular statements below.

Similarly, we should talk of pseudo-saving and pseudo-income when talking about valuation changes in asset (and liability) values. “Pseudo†does not mean it does not have real effects. It is precisely because stock measures of wealth are perceptions that they have unpredictable effects on real economic activity — and that these effects can be bigger the more unwarranted the perceptions are. But it is still real economic activity — as captured by conventional national income flow measures — that we should ultimately care about.

This is basically a statement about variability. Holding gains/losses are extremely variable. And yes, that variability — at least over the short to medium term — seems to be heavily driven by perceptions, optimism, confidence … “animal spirits.” So you, we, can’t really “(ac)count on” those holding gains being “real.” They might vanish this year or next as perceptions change.

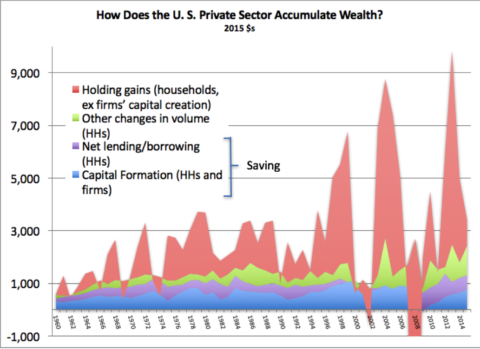

But variability is a function of time: how much does a measure vary over X period of time, Y period, etc. Holding gains are quite variable across our arbitrary one-year accounting periods. But over decades or a lifetime — or a dynasty’s lifetime, or the lifetime of a social, economic class — they’re very reliable indeed. Over any period greater than five or ten years, at least in the U.S. since 1960, they are consistently and reliably the overwhelmingly dominant method of wealth accumulation.

J.W. Mason makes that point very well in this post commenting on Piketty, from a couple of years ago, recently and appropriately re-upped by Cameron Murray on Twitter. Holding gains are the primary way that people (and we, collectively) get “rich” in balance-sheet terms.

If valuation changes, holding gains, are pseudo income and pseudo saving, then most of our monetary wealth, our balance-sheet assets and net worth — which has accumulated overwhelmingly through holding gains — is also pseudo. Or at least you have to ask: when do those balance-sheet changes, and the accumulated monetary wealth from those changes, become “real”? At what point do you decide that perceptions have become reality?

Amazon is the poster-child example for this. Despite showing essentially zero accounting profits over a quarter of a century, it has delivered half a trillion dollars onto shareholders’ balance sheets via holding gains — notably including Jeff Bezos’ balance sheet. Was that “real” income and saving? Is it now? Is the accumulated wealth “real”? Jeff Bezos owns The Washington Post. He’s throwing rockets into space. That seems pretty darned real.

Is Jeff Bezos “not as rich as he thinks”? Are ETF-fund investors who focus on total returns just foolish mugs?

Another way to illustrate this is to consider the free (advertising-supported) online services that people enjoy. (Recently discussed in a great Twitter thread with Sri Thiruvadanthai and Brad Setser.) How do we account for those? How do they enter into GDP? (The domain of “real” income, as tallied in the NIPAs and the FFAs, with no consideration of holding gains.) Google and Facebook sure seem to be creating and delivering “value” of some kind with those services…

The short answer is, they don’t get counted. Advertising spending isn’t part of GDP; it’s counted as an intermediate input to production, so it gets “backed out” of the GDP measure. This seems like a problem; there’s surely value, consumer surplus, being produced and delivered to the household sector; shouldn’t that show up in GDP? But no accountant is going to feel comfortable posting the imputed dollar value of free cute-kitten surfing as household-sector monetary “income.”

What actually happens: The profits from those advertising revenues are posted to firms’ balance sheets, increasing their book value. (Note that Facebook, Amazon, and Google, like other techs, don’t distribute their profit as dividends; they keep it on their books.) The markets see that increased book value, and bid up the companies’ stock prices. Voila, holding gains: every holder of those companies’ equities has more assets/money.

The household sector, ultimately, owns all the equity in the firms sector, at zero or more removes. The firms sector is a wholly-owned subsidiary of the household sector. (Because households don’t issue equity; firms can’t own households — at least not yet. It’s an asymmetrical ownership relationship. The ownership-accounting buck stops at the household sector.)

So the consumer surplus from “free,” advertising-supported online services is delivered onto household balance sheets (equity-owning households, at least) — via holding gains. The surplus is hidden in those gains. But that very real surplus is invisible in GDP. Should we call those holding gains, derived from real production surplus, “real” income?

My answer: New claims from holding gains, posted to balance sheets to the tune of trillions of dollars a year, variable as they are, are real claims. They can be (are) employed to buy stuff — notably including other people’s labor. (Yes: the asset markets must be liquid, there must be enough people swapping assets for this to work in practice.)

I address this from another, wonky angle — book-value versus mark-to-market, market-cap accounting, here. (Includes empirical data!)

Replying to some particular points in Martin’s post. He characterizes my thinking as follows:

economists miss much of what goes on in the economy by focusing largely on flows of income, spending and saving rather than the stocks of wealth, assets and liabilities.

I think this misses the key question: what do we mean by a “flow”?

There are three proximate financial mechanisms that create new ab novo private-sector balance-sheet assets — monetary wealth: 1. government deficit spending, 2. bank lending, and 3. holding gains. (Plus rest of world.)

Holding gains are special, completely unlike the other two. Because while holding gains is a flow measure (measured over a period), there is no actual flow. The new assets don’t come from anywhere, from any other sector. When there’s a market runup, everybody just marks their balance-sheet assets up to market. Nobody posts any new liabilities that you could identify as a “source” or flow for those increases. This is why holding gains are (must be) invisible in the balance-to-zero circular flow of the NIPAs and the FFA matrix.

And as detailed above, that non-flow “flow” of holding gains can derive pretty explicitly from real production and surplus.

As an aside, personal saving — spending less than your income — is another of these non-flow flows. It’s a residual flow measure of two actual flows in a period — income minus expenditures. (Household expenditures are all or mostly counted as consumption expenditures; it varies across different national account tallies.) It’s a measure of what’s not spent — income that’s not transferred to others’ balance sheets, accounts. It’s “not-spending.”

A focus on “net worth†and capital gains and losses draws our attention to assets — but liabilities, and the composition of each, matter hugely as well.

I addressed this in my reply to Matthew. Short form: This is like saying that a focus on revenues (assume we’ve been ignoring, failing to measure or analyze them) draws our attention away from expenses (which we’ve been tallying and analyzing very thoroughly). No: actually paying attention to balance-sheet assets, and where they come from, doesn’t “distract us” from liabilities (which are tallied well in the FFAs, and deeply analyzed by econs).

Paying attention to assets and their accumulation, monetary wealth, just increases what we’re paying attention to.

And: “net worth,” obviously, doesn’t ignore our well-accounted-for liabilities. They’re what net worth is “net” of. But you can’t get to net worth without a tally of total assets — or change in net worth without a tally of holding gains.

“Saving†in the sense of valuation increases does not correspond to anything on the ground, as it were.

I disagree. Over the long term at least (assuming “animal spirits” ebb and flow), valuation increases are the existing-asset markets saying “Wow, it looks like the markets for newly-produced goods and services got it wrong when they priced these goods. They’re actually worth more than we thought they were. They’ll deliver more value (via consumption or as inputs and services to production of goods) than we thought they would.” That’s them looking at all the “stuff on the ground” and giving their estimate of what it’s worth. (See the accompanying post on these two accounting/estimation methods.)

an economy as a whole cannot spend out of its financial wealth without devoting more of its actual current production to consumption

I think this is a widespread error of economic thinking. “Spend out of” is the problem; it’s an error of composition. When you “spend out of your wealth” — transfer assets from your balance sheet to someone else’s — nothing “comes out of” collective wealth. The assets still exist; they’re just in different accounts, on different balance sheets.

This is another instance of the “real stuff” vs. money confusion, here confusing consumption with consumption spending. When you eat more corn — literally consume — we have less corn. If you spend more to buy corn, we have the same amount of money.

So an economy can quite easily “spend [more] out of its financial wealth,” turn that stock over more rapidly, at higher velocity, with that extra spending going to either consumption spending or investment spending. Whatever.

The consumption spending doesn’t reduce our stock of goods/stuff, because the spending doesn’t happen if equal production doesn’t happen. Produced/sold goods minus consumed/purchased goods = zero (with some inventory/buffer-stock fluctuation period to period). This especially in a 70% service economy, where most goods are produced and consumed simultaneously; in a service business, inventories don’t exist. There’s no stored “stock” of labor hours.

(Net) Investment spending (“capital formation” in the IMAs) does increase our stock of stuff, which is then collectively monetized/assetized (fitfully) via the three financial mechanisms listed above. So okay: a larger proportion of consumption vs. investment pending does forego some wealth creation via capital formation-and-monetization. But it doesn’t destroy or diminish wealth as implied in the statement here.

Quite the contrary: Faster turnover of wealth, higher velocity, causes more production, investment, and consumption (assuming price inflation is in check). There’s no “spend out of” involved.

people chose to save more in the only way they collectively can: by spending less

I think Martin means “in the only way they individually can.” Individual saving has no accounting effect on the collective stock of assets. It only affects which accounts/balance sheet hold those assets. When you don’t-spend out of income, it just means you’re holding the money/assets in your account instead of transferring them to another account (by spending). Full stop. (Household debt repayment does reduce the household sector’s, and the financial sector’s, stocks of assets, shrinking balance sheets on both sides. Liabilities also decline on both sides, though, netting to zero, so it doesn’t change private-sector net worth.)

My main point is, again, political. Income measures that don’t include holding gains, saving measures that don’t sum to changes in assets and net worth, make invisible the primary method whereby owners get rich, stay rich, and get richer (without having to work). Until recently, even the total wealth measures were unavailable or squirreled away in separate tables that are themselves reliant on yet more obscure (“Reconciliation”) tables.

Economists are deeply implicated in that politically pernicious depiction of economic reality — mostly unconsciously. That’s forgivable, perhaps, because economists receive no formal training in accounting theory or practice. (Is that forgivable?) But the result: even a remarkable student of wealth like Thomas Piketty is unable to perceive that his own second law is accounting-incoherent. It presumes that wealth increases all come from “saving.” Which isn’t even close to true. (Again, see J.W. Mason’s great piece.)

Thanks as always to my gentle readers…

Comments

2 responses to “Are Holding Gains “Pseudo” Income? A Response to Martin Sandbu”

Re: “Is that forgivable?”

No. It is not forgivable. In physics, just everything can be analyzed from the point of view of free-body interactions. Change in state is a function of the combined forces acting on an object. You can do esoteric quantum mechanics or be accounting for general relativity, but you have to get the proper local behavior.

One of the biggest flaws in modern economics is that it is inconsistent with accounting. Economists are always positing behavior that makes no sense from an accounting point of view. How can one consider rational agency when the macroeconomics is inconsistent with entity accounting. That’s why we hear nonsense about encouraging hiring by cutting business taxes without stimulating demand.

Every time I encounter an economist, and there are more and more of them lately, who seems to recognize that this is a problem, I feel I have to offer a few words of encouragement. Consider these words of encouragement.

@Kaleberg

Two thumbs up. Thx.