I’m stealing this headline directly from Sandwichman. He sez:

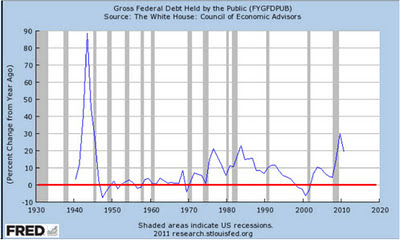

No it doesn’t. It almost never is. To pay back government debt, you have to run a budget surplus, and while there may be modest surpluses from time to time, they don’t add up to more than a minuscule fraction of all the accumulated debt. But don’t take it from me, look at the record.

Here’s a longer-term view, zoomed in on successive times slices so you can see the changes:

Do you notice our progenitors’ great-great-grandchildren (us) paying off our forebears’ debts? Yeah, neither did I. (It did happen once, and the result was economic catastrophe. Every depression in our nation’s history was preceded by a big decline in nominal Federal debt.)

Here’s the U.K.:

David Graeber, from Debt: The First 5,000 Years:

The reader will recall that the Bank of England was created when a consortium of forty London and Edinburgh merchants — mostly already creditors to the crown — offered King William III a £1.2 million loan to help finance his war against France.

To this day, this loan has never been paid back. It cannot be. If it ever were, the entire monetary system of Great Britain would cease to exist.

That was 317 years ago — in 1694.

Governments that issue their own money don’t have to pay off their debts. They actually can’t. In fact, they issue money — the money that’s necessary for a growing economy to operate — by deficit spending.

Private borrowers (and non-sovereign-currency states like Greece and Alabama) do have to pay off their debts (or default). That’s why the level of private debt, not sovereign debt, is the big management problem — a problem that neoclassical economics has not tackled, does not even have the theoretical apparatus to tackle.

Yes, of course: government debt and interest payments as a percentage of GDP are important issues. I’ll hand it back to Sandwichman:

The debt burden depends on the ratio of debt to GDP as well as the interest cost in servicing it. The way to reduce this burden is to have a combination of real economic growth, inflation and modest interest rates. If you want to show your solicitude for the well-being of future generations, demand macroeconomic policies that will boost demand and raise inflation a bit, consistent with continued low interest rates.

Today’s creditors will hate you. But your grandchildren will love you.

Update (thanks to Buffpilot at Angry Bear for finding holes): A more precise explanation of why a sovereign-currency issuer might “have” to pay back their debt: if they have committed to redeem their money for something else. For instance Argentina (dollar-denominated debt) and whole host of others who were on a gold standard, had promised to give gold in return for their money. If they can’t or won’t do so, that’s a default on their promise. The U.S. and the U.K. (among others) do not face that situation.

Cross-posted at Angry Bear.

Comments

12 responses to “The Meme that Refuses to Die: Government Debt Must Be Paid Back”

[…] Reading: Steve Roth on government debt not having to be paid back. GA_googleAddAttr("AdOpt", "1"); GA_googleAddAttr("Origin", "other"); […]

I really liked this article, but I have one quibble. A government could lower its debt by printing money and buying its bonds. I suppose some people consider fiat money a form of government debt, but in that case, they could tax and burn, which, while destructive, would reduce total debt levels.

James: “A government could lower its debt by printing money and buying its bonds.”

That’s pretty much what the Federal Reserve does when it buys treasury bonds…

But the concern about government debt is misplaced. It is private debt that hinders private sector growth. Not government debt.

@James Oswald

“A government could lower its debt by printing money and buying its bonds.”

Or even better: don’t even issue bonds. Just issue (dollar) bills! See the Modern Monetary Theory crowd. (A good start: the Randy Wray paper linked from the nominal debt link above.)

But yes: Ron Paul (for kind of wacky reasons) suggested the notion the Fed should simply shred all the treasury bonds it’s holding, reducing U.S. debt by $1.6 trillion! If like the MMTers you see treasury and the fed as all part of the government, it’s not crazy… Though there are definitely practical difficulties to utterly changing the monetary system we’ve been using, even if it is a ridiculous and archaic system based on a gold-standard monetary system that went away at least 38 years ago.

@The Arthurian

“It is private debt that hinders private sector growth.”

I’ve been pondering this one. “Hinders”? I don’t really doubt that statement, but…

I think it’s obvious — Fisher, Minsky, Keen — that private sector debt issuance is what (mostly) causes big periodic crashes. And Bezemer has kind of shown me how increasing debt sucks resources from the real economy — real investment in productive assets. But I don’t have it really internalized so it makes clear intuitive sense to me. Partially because I don’t really believe that a (imagined) shortage of financial capital seriously impedes entrepreneurship. (See my NFIB posts; there always seems to be plenty, for those who can actually profit from it.)

The finance industry sucking talent from truly productive industries is another way, but (no matter how much it pisses me off) I tend to question how big that effect is.

You?

[…] Cross-posted at Asymptosis […]

@Asymptosis

Is it private debt that hinders private sector growth? Or, is it public sector debt purchasing private sector debt in dis-equilibrium? All the monetary attempts to “fix” the economy have been primarily been in the form of purchasing questionable assets at above market pricing. No attempt at minimizing the consumer/public sector debt whatsoever.

Art isn’t wrong with his argument that there has been a dramatic increase in “public debt.” But, as he has noted before, this was a result of deliberate policy matters. Extracting more “rent” from the middle class without a means of insuring the ability to repay the debt, (increased productivity without increased wage gains) is at the core of the problem.

In a recent discussion, Dylan Ratigan had Yves Smith define the latest twist on the problem: “Greedy Bastards like to call themselves capitalists, but what they’re actually doing is the exact opposite: it’s extractionism: taking money from others without creating anything of value; anything that produces economic growth or improves our lives…..”http://www.angrybearblog.com/2011/12/extractionism.html

Your thoughts?

[…] In fact, the economy will collapse it it does. Published: December 20, 2011 Leave a Comment Name: Required […]

@Asymptosis

It could not print money, because of the 1917 law instituting the “debt limit” – The Treasury cannot issue more than $450M of Treasury notes because of a post civil-war law. The Treasury can however issue platinum coins in any denomination TBD by the Secretary of the Treasury because of a 1996 law, and this issuance is not subject to the debt limit. So Beowulf’s platinum coins are currently the only legal way to “pay off” the National Debt!

[…] I agree. The answer was “maybe.” (Especially given the long-term historical reality of the Galbraithian scenario described above.) And in my mind it still is — with a little […]

[…] ago,” I agree. The answer was “maybe.” (Especially given the long-term historical reality of the Galbraithian scenario described above.) And in my mind it still is — with a little […]

[…] This is why government debt is not never, has not ever been, cannot ever be, paid off. […]