In my ongoing efforts to clarify national-accounting-speak (for myself and others), I’d like to take a stab at some language that is often used ambiguously: the notion of “public” debt. (See also Thinking About the Fed.)

If you don’t think anyone is confused by that term, understand: in “public debt,” “public” means government. In “debt held by the public,” “public” means non-government.

I’m prompted to tackle this by a statement from Adair Turner in this very interesting discussion over at VoxEU. (Hat tip/further discussion: Simon Wren.)

If Japan had used [helicopter money], it would now have some mix of a higher real GDP level, a higher price level, and lower public debt to GDP.

I think the last phrase in this statement (“lower public debt”) is potentially confusing, and I’d like to explain why.

The meaning of “public debt” depends on the accounting/balance-sheet view you’re adopting. Each is a perfectly valid accounting construct; each depicts the situation differently. Some views may be more useful than others in sussing out how things work/are working.

1. The view from the Treasury balance sheet, with 1. government trust funds (Social Security, etc.) and 2. the Fed viewed as external entities. Generally referred to as “gross public debt.” The treasury bonds/bills held by those external entities are liabilities of Treasury. It must pay interest, and eventually principal, to those entities. (Though those payments flow right back to Treasury, and/or don’t flow out, depending on how you describe the “flow of funds.”)

2. The view from the “unified” balance sheet. Generally called “debt held by the public.” This consolidates the Treasury and trust-fund balances (viz: the “unified budget“) into a single “government” balance sheet. Treasury’s debt/liability to those funds is internal to government (one department just owes another), so they vanish from this consolidated view. “Government” liabilities consist only of bills/bonds held by external entities.

But crucially: those external entities include the Fed. In this view, the Fed is part of “the public,” and its bond holdings are “government” liabilities. “Government” owes money to the Fed. (This again nothwithstanding the fact that interest and principal flows from Treasury to the Fed flow right back to Treasury.)

3. The view from a fully consolidated “government” balance sheet, including Treasury, the trust funds, and the Fed. Debt consists of bonds/bills held by parties external to that “government.” There is no common name for this construct, and you rarely if ever see the situation depicted this way.

4. The view including GSEs (Fannie/Freddie). The Fed is buying $40 billion/month in mortgage-backed securities from these entities. They owe the Fed money, just like Treasury owes money to the trust funds. Those entities are quite arguably part of “government” (Treasury will always cover their liabilities, though perhaps using Fed machinations as the vehicle), so it’s not crazy to view this as another instance of “government owing money to itself.” If you consolidate these entities into the “government” balance sheet, “debt held by the public” includes truly non-government entities’ holdings of Treasury and GSE bonds/bills. As with #3 (but more so), you never see the situation depicted from this view.

Back to Turner’s statement: From view #2 (“government” is Treasury but not the central bank), if Japan had taxed less and issued bonds/borrowed instead the direct result would be higher “government” debt to GDP compared to a normal tax-and-spend approach. It owes all that money to an external entity: the CB. This would only be ameliorated to the extent that second-order effects — policy-induced NGDP increases — resulted in higher tax revenues.

But from View #3 (government including the CB), “public debt” would be less. Instead of taxing or borrowing money from the true non-government “public,” with the CB buying the bonds Treasury is effectively borrowing from the CB. Again: it’s just government owing money to itself.

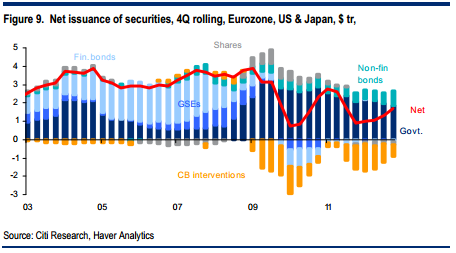

Personally I’d like to see a lot more thinking and analysis from the perspective of View #4. In particular I’d like to see flow analysis from that perspective, showing the net Net NET flow of additional treasuries/GSEs into the private market after Fed “retirements” (under the theory that a smaller net incoming supply of additional financial assets will result in higher financial-asset prices). See for instance this Citi graph, which both Cullen Roche and Izabella Kaminska (no mean monetary thinkers) consider to be especially enlightening:

I would also suggest with some trepidation that their emphasis on “safe” assets might be misplaced, that the effects that are of interest might simply result from a reduced “supply” of financial assets, period. Which is why QE raises both bond and stock prices. But only while QE continues.

Cross-posted at Angry Bear.

Comments

5 responses to ““Public” Debt and Safe Assets: A View from Space”

[…] Cross-posted at Asymptosis. […]

[…] your work, in particular specifying the balance-sheet perspective(s) you’re speaking from. Treasury (on balance sheet or unified)? Fed? Both consolidated? Private sector? Financial sector? […]

[…] your work, in particular specifying the balance-sheet perspective(s) you’re speaking from. Treasury (on balance sheet or unified)? Fed? Both consolidated? Private sector? Financial sector? […]

Laurence Kotlikoff goes even further: http://www.pbs.org/newshour/rundown/2013/05/kotlikoff-on-the-real-problem-with-reinhartrogoff.html. Why not call Social Security obligations debt? Why not all future-dated government payments? Why are Social Security contributions taxes and not borrowing?

@JW Mason

Yeah. I’ve pointed out repeatedly that — example — the bonds held in the gov trust funds are absolutely arbitrary measures of SS and Medicare’s assets or Treasury’s liabilities. Most people (who aren’t being intentionally obtuse — conservatives) understand this well enough to talk about “debt held by the public” rather than “gross public debt” (which includes those arbitrary measures).

I hadn’t really grasped until Dean’s piece, though, how arbitrary “debt held by the public” is as a measure. (Even before trying to decide if Fed-held treasuries should be included in that measure. [They are.])

I think I tried and failed once to calc “government debt held by the real sector” (households and nonfinancial businesses), under the notion that banks are just licensed franchises of the fed, and the fed is just a licensed franchise of Treasury…all government (or finance, call it what you will) in that view from space…