If you’ve ever been involved in a legal contention, like a business or personal dispute or a contested divorce, you know that the whole game pivots, ultimately, on the potential end game: what would happen if the thing went to court — even if (even because) everyone involved knows that it never will. The fact that it could, and the expected results if push did come to shove, determine the terrain of the playing field and the positions of the players, and all the ploys and counterploys played out on that field.

Ryan Avent brings that principle to bear in one of the nicest pieces I’ve seen laying out the game theory of monetary policy over the next couple of years. For my purposes, starting with the end game (my bold):

At one extreme, we can imagine a situation in which America’s government has entirely lost market confidence and is unable to sell its debt. In that case, the central bank, as lender of last resort, would be unable to avoid stepping in to buy that debt, in the process transferring control over inflation to the fiscal authorities.

Voilá: MMT World, where Treasury is simply spending newly-created money into existence, at the behest of the legislative and executive branches, by depositing it in recipients’ bank accounts. Bond/debt issuance is immaterial, because the Fed has no choice but to buy all the new bonds for “cash.” (Yes, the Fed is actually “printing” the money, but effectively the Treasury is doing so.) There is no Fed “independence.”

This is the scenario that would result if the Republicans were foolish and feckless enough to take their chicken game to the limit and let the head-on collision actually occur, with a default on U.S. debt. It’s the expected (inevitable) result if they “take it to court” — at least if they leave it that way for any period. (Has anybody mentioned the irony of the Republicans’ claim to be creating “confidence”? And, do you think they’d like the MMT World that they’re unwittingly trying to create? They really should, given how much they dislike the “unelected” Fed making decisions…)

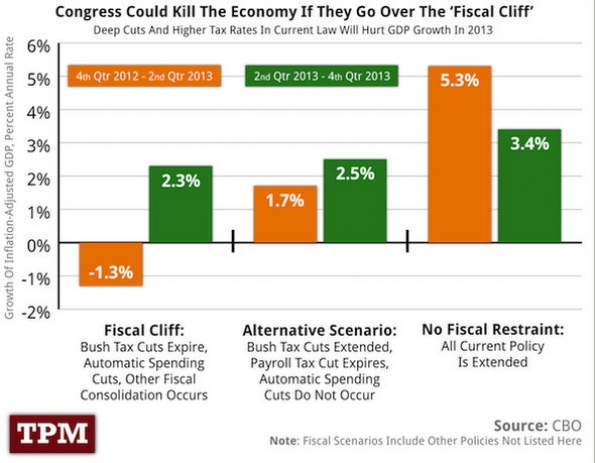

Now moving one step back from that end game, Ryan looks at three “fiscal cliff” scenarios as projected (PDF) by the Congressional Budget Office (using a graphic from Brian Beutler at Talking Points Memo):

Just to multiply this out for you, one-year growth under the three scenarios (Q4/12–Q4/13) would be circa 0%, 2%, and 4%.

These scenarios all assume that the Fed does “nothing” in response — which I’ll define as keeping their balance sheet the same size, with no big (net) bond/asset purchases or sales, and making no announcements that that will change.

Which means we need to take another step away from the end game. Here looking at the righthand scenario:

Except, of course, that the economy will almost certainly not grow at a 5.3% rate no matter what Congress does. Arguments to the contrary are subject to what econ bloggers have come to call the Sumner Critique… Growth that rapid would … [prompt] steps to tighten monetary policy.

In Sumner’s words, the Fed — as the last player in every round of the game — would “sabotage” any growth that rapid (especially, I would add, if it saw any traces of that terrifying bogeyman, “wage inflation”).

All the players know that the Fed can do this by simply selling bonds (something they have no shortage of). Bond prices drop, yields and market rates rise, people borrow and spend less, confidence drops, stocks decline, people feel less wealthy, unemployment rises, inflation (and growth) are held in check. As they are at pains to remind us, the Fed has spent decades building this inflation- (and, collaterally, wage- and employment-)quashing credibility.

Nor does anyone doubt that they will do it. They always do, have done since Volcker.

But what about the other push-comes-to-shove scenario — the “fiscal cliff” on the left?

The Fed could therefore proclaim to the world that will maintain aggregate demand growth (in the form of, say, nominal income growth) at all costs, and that it would by no means allow the fiscal cliff to knock the economy off its preferred path. It could explain in great detail what specific steps it would be willing to take to achieve this goal, so as to boost its credibility. And if demand expectations as reflected in equity or bond prices showed signs of weakening ahead of the cliff, the Fed could preemptively swing into the action to establish the credibility of its purpose.

The Fed will almost certainly not do this.

And everybody knows this. After three decades of taking away the (wage- and employment-)growth punchbowl when the party starts getting (“too”) hot, and after four years of subordinating their employment mandate to their cherished inflation-control credibility, the Fed has a serious shortage of “growth credibility.”

Which means that the Fed has created a game that is asymmetrical. It has great power to quash growth through open-mouth operations; we know they’ll sell bonds if they promise and need to, and that doing so will dampen inflation (and growth).

But on the expansionist side, we can’t believe their promises. They would need to make actual bond purchases to spur growth. And even if they do both promise and live up to the promise, we (with the exception of [market] monetarists, few of whom are running large businesses or managing large amounts of money) don’t have great or certain expectations for the results.

“Show me QE3, and show me the results; I’ll believe it when I see it.”

But: Why won’t the Fed adopt policy that delivers strong GDP growth?

There’s the runaway inflation/loss-of-credibility explanation, of course. But the Fed isn’t run by adolescent freshman Republicans who think that 3 or 4 percent inflation is the slippery slope to ZimbabWeimar. They know that if they promise to let inflation rise then fall over a few years, then do exactly that, it would greatly stengthen their inflation-control reputation and credibility.

And there’s my theory: it would transfer hundreds of billions of dollars in real buying power per year from creditors to debtors, and the Fed is run by creditors. (Depression is a choice.)

Ryan has a different theory:

…moral hazard… if [the Fed] promises to protect the economy against reckless fiscal policy Congress will have no incentive to avoid reckless fiscal policy. … lay out a plan for medium-term fiscal consolidation but keep short-term cuts small and manageable.

Now you gotta ask whether manipulating the legislative and executive branches into being “responsible” by setting their expectations is any part of the Fed’s mandate. Talk about a nanny state.

But that aside: this is exactly what the Fed is doing, and has done for thirty years with its inflation-fighting moxie — (promising to) “protect the economy against [so-called] reckless fiscal policy” by reining in inflation (and wage and employment growth). It’s called The Great Moderation. (So by Ryan’s reasoning, the Fed has spent three decades encouraging “reckless fiscal policy.”)

Ryan thinks that the Fed’s afraid that it:

…will need to roll out dramatic, unconventional actions–the fear being, of course, that such actions would leave it hopelessly politicised and powerless to fight inflation. … [They’re] fighting to maintain their vulnerable independence.

Translation: They’re fighting to avoid the MMT-World end game, where the Fed becomes an irrelevant mechanical actor.

And one price of that fight may be the need to occasionally allow fiscal policy to matter–as unfortunate Americans may soon learn.

Why “unfortunate”? Where did that come from?

Is the prospect unfortunate because runaway inflation will result? You can count our problematic inflation periods from the past century on two three fingers. Now count the recessions.

Or is it because higher government debt will be a drag on growth? Vague and poorly reasoned concerns based on a few here-and-there sample points nothwithstanding, we’d be well advised to look to our last bout of serious public debt increase: the one that ended in 1947, and was followed by the fastest decades of economic growth in living memory.

Cross-posted at Angry Bear.

Comments

4 responses to “The Fed Faces the End Game — And Blinks?”

Are you so certain that the Fed could raise market rates by selling bonds for excess reserves? Raising interest on reserves would be better, but I think we need to acknowledge that the monetarist view where there is just “the” interest rate, “set” by the Fed, is not a good representation of reality. There are a number of episodes in recent decades (and to a lesser extent earlier) of central banks significantly raising policy rates with no effect on market rates.

I agree with you 100% on the political economy of inflation targeting, I’m just less confident that the Fed can always hit its targets.

@JW Mason “Are you so certain that the Fed could raise market rates by selling bonds for excess reserves? Raising interest on reserves would be better”

I admit that I haven’t internalized — or really reached, actually — a decent understanding of the game under an IOR system, either at the ZLB or above it. (I think the game’s very different in the two scenarios?)

I’m here to suggest that a large portion of the economic and financial community is in a similar situation. (This especially as so many of them have yet, after forty years, to even adapt their thinking to a non-gold-standard world of unredeemable fiat money and freely floating exchange rates.)

I can think of a very good thinker with the first initials JW who might be able to help us with a clear and cogent post on this IOR vs OMO/QE issue. Or, links welcome.

But I think the main point remains. The Fed has a lot more moxie when it comes to stepping on growth in response to fiscal spurs than the reverse.

Thanks for saying this.

Market Monetarism always confuses more than it clarifies. MMT always clarifies.

Monetary policy is pretty much worthless. In spite of the Asymptotic observation that the Fed quashes growth to quash inflation, the last 30 years demonstrate just the opposite. Interest rates have gone down steadily because inflation has gone down steadily because of globalization and the erosion of labor’s clout. The Fed and monetary policy have been and continue to be irrelevant.

Anyone with a brain knows that bond purchases have very little effect since they are just a swap of one extremely liquid asset class for another. Please do not feed the Market Monetarists…