If the modern monetary theory folks are right, there’s no reason the government should be paying interest above inflation on bonds and bills. It’s an artifact of the gold standard, utterly unnecessary (and economically destructive) in a fiat-currency economy.

This realization courtesy of a February policy note by Jamie Galbraith that I just came across:

… how reasonable is it to assume a 3 percent real interest rate on US public debt? … it normally should not be so for a sovereign borrower who controls her own currency and therefore cannot default. … to an investor safety is valuable, and … under capitalism making money ought to require taking risk. There is no reason why a 100 percent–safe borrower should pay a positive real rate of return on a liquid borrowing!

The federal government doesn’t need to compensate for risk. It isn’t trying to kill off a high and intractable inflation. It also doesn’t need to lock in borrowing over time; it pays the higher rate on long bonds mainly as a gift to banks.4 Moreover, it controls both the short-term rate and the maturity structure of the public debt, and so can issue as much short debt at a near-zero rate as it needs to.

Average real returns on the public debt were in fact negative in 18 of 36 years from 1945 through 1980 (measuring against the realized inflation rate). They were slightly negative on average over that entire period … Today, with inflation low, consistently negative average real rates on all public debt are again possible, especially if the government stops propping up bank earnings by issuing long-term bonds.

Yes, bond investors face the risk that inflation will increase, and future returns will be negative. But how does that explain the issuance of Treasury Inflation-Protected Securities (TIPS), which guarantee a fixed rate above inflation — return with no risk? If savers want to earn a return above inflation, there are plenty of options out there — notably real assets, and the semi-real assets embodied in equities.

Yes, they all have risk. Quel dommage. If you want real returns, invest in something real.

While Galbraith doesn’t say it here, this leads inexorably back to the MMTers’ main point: there’s no reason for the government to issue debt; it could simply spend instead — issue zero-interest (dollar) bills instead of interest-bearing bills. Government bonds — and their use by the Fed to manipulate interest rates — are simply market distortions.

And that leads to the real aha! of Galbraith’s paper:

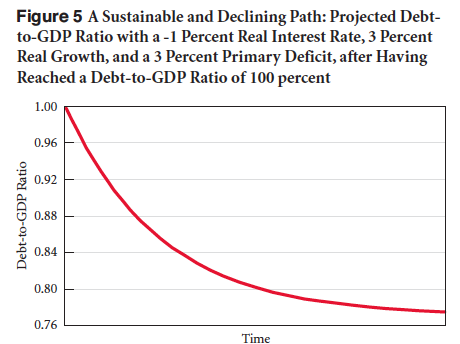

So long as interest rates exceed growth rates, any primary deficit is “unsustainable.â€

Check out his graphs:

The government budget is on an “unsustainable” path for one reason only: because it issues bonds (especially long-term bonds, especially TIPS) — an ongoing gift to the banks.

Who benefits from those bonds? Financial arbitragers. Rentiers. With the active support of the Fed’s “open market” manipulations, they are a vehicle for funneling taxpayer dollars to the — literally — idle rich while sucking sustenance from the real economy. (In this case via interest payments using taxpayer dollars.)

Now: are you wondering where those “unsustainable deficits” are coming from?

Comments

9 responses to “The Real Return on Treasuries Should be Zero. They’re Risk-Free.”

Or the return on treasuries reflects reinvestment risk of the coupon payment.

See also: Liquidity preference theory to the term structure of interest rates.

… they are a vehicle for funneling taxpayer dollars to the — literally — idle rich while sucking sustenance from the real economy.

Just a minor quibble: from the MMT perspective taxpayers dollars fund nothing. Not even interest payments on treasuries also known as government welfare for the top-end of town.

@Stephan In toto you’re right. But I don’t think anyone would suggest that choices of what (and who) to tax and what (and who) to spend on has zero effect on wealth distribution.

@bkmacd Isn’t this saying there’s risk of future risk, and that those twice-removed financial risk-takers should be compensated? I’m thinking that potentially productive risk certainly merits potential return. Not sure that arbitrage risk is in the same category.

If I have a choice between a long and a short term bond, the long term bond should reflect some premium for reinvestment risk (whether it overcomes the market expectations of future interest rates is a different matter). Just because that risk potentially occurs at some point in the future doesn’t mean that you’re not taking it on.

Whether or not you personally feel that taking on one type of risk versus another is worth being compensated for has little to do with whether a premium will exist for said risk.

@bkmacd You’re absolutely right re: my personal feelings, at least if we assume that real interest rates arise purely from the private market. But if we accept treasury and Fed actions (at least try to) actively manipulate those rates, and that those manipulations result in winners and losers, it’s somewhat otherwise.

I probably should have stated clearly what was only lurking in the back of my mind, that this is a response to the Reinhart/Gross whining about “financial repression” by the Fed. As I said in an earlier post, my heart bleeds.

Except rates on the long end are not set by the Fed. And QE2 didn’t exist until, uh, last summer.

Indeed, the entire idea that a sovereign “doesn’t need to lock in borrowing over time” seems strange. If anything, a sovereign issuing long dated maturity debt acts as an option on inflation (and is a bet on higher than expected inflation), and so the maturity structure of debt might merely reflect the past thoughts on future inflation. Or there could be some other value to having long term default risk free debt obligations (to appropriately match assets and liabilities).

While Reinhart/Gross whining about “financial repression” is indeed gross (heh), going full bore the other way and stating that issuance of long debt by the treasury is an intentional gift to the renter class is equally an act of logical absurdity. Either way, paying interest on long term bonds, from an MMT standpoint doesn’t “[suck] sustenance from the real economy (In this case via interest payments using taxpayer dollars)” because said payments are a creation of money (taxes destroy money, spending [and interest payments!] create money).

@bkmacd Dammit, I wish you wouldn’t enunciate (clearly) the counterarguments that were lurking, poorly formulated, in the back of my head while I was writing my last response to you. ‘Nuf to piss a guy off.

>Except rates on the long end are not set by the Fed. And QE2 didn’t exist until, uh, last summer.

Like that, for instance.

But just because investors — mostly “bankers” in this market — inevitably demand a higher return for the reduced liquidity/”risk” of long bonds, does that mean that government should fulfill/supply that demand? “Tough luck. Hold dollars.” Would we have a more efficient market, less distorted by Fed machinations? It sure seems like it would remove one method whereby money moves to the top.

> going full bore the other way and stating that issuance of long debt by the treasury is an intentional gift to the renter class is equally an act of logical absurdity.

“Intentional”? Je ne sais pas. I tend to wonder whether economists/financiers actually understand money economies well enough to engineer such a conspiracy. But that doesn’t mean that the bond-based system doesn’t have the effect I describe, or that the winners in that system don’t actively or even frantically maintain it for that (semi-conscious?) reason.

Yes, as you suggest, it’s possible that the dynamic system that exists with government bond issuance/manipulation/markets yields greater prosperity than a dollars-only system would. I don’t know if there’s any way we could know that, even via weather-system style dynamic modeling of the type that isn’t really, sadly, even on the horizon in the economics dodge. (Oddly, Steve Keen in his workmanlike, accounting-based approach, seems to be getting closer, faster, than the seemingly sophisticated Santa Fe gang.)

I’m seeing a really close parallel to the “New Monetary Economics” that Tyler gets so gushy about.

http://marginalrevolution.com/marginalrevolution/2011/06/the-new-monetary-economics-is-alive-and-well.html

Their notion is that we should eradicate government money, so the only money-like things are private financial instruments. Its stronger proponents claim that it would eradicate the business cycle (which I prefer to call the financial cycle). I think they’re on the fully-loony end of the “free markets will solve everything” spectrum.

MMT is semi-opposite — government only issues dollars, no debt. Is it equally utopian? No, because:

1. It envisions management by government, rather than magical equilibrium via the markets.

2. It explicitly addresses the distribution issues that have been systematically excluded from neoclassical theorizing, which very issues might be the primary cause of financial cycles (at least the big ones, the long-term culminations).

3. Its proponents have enunciated a clear countercyclical automatic stabilizer policy method to implement it that addresses the political problem of implementing real-time discretionary fiscal policy: guaranteed employment. (The issue they haven’t solved, to my knowledge: what is the political method whereby the government employment wage is set?)

[…] and rewriting this from what I wrote in the comments. Thanks to bkmacd for prompting it by coming back at me on some issues. His key […]