Jim Manzi was nice enough to drop me a note in response to one of my comments, and he pointed me to his National Review piece, “A more equal capitalism: preserving the free-market consensus.” I ended up writing some lengthy responses, and not being one to waste perfectly good copy, I decided to post them here.

Dear Jim:

Thanks very much for the pointer. I’m delighted to see a right-leaning opinionator saying that we should be thinking about prosperity and equality–that there’s lots we can do to promote both. When I hear that on the right, the tone is usually one of somewhat grudging acknowledgement of the need for some equality bolt-ons. (The best of the left, OTOH, embraces both wholeheartedly, and in a unified way, trying find paths and policies that can achieve them in tandem.) Your piece is a nice exception–a perfect example of where we can find common ground and agreement.

Responses to random bits:

It is hard to exaggerate the strength of the U.S. competitive position in the world economy in June 1945

So true. Damn I was lucky to be born in America in 1958.

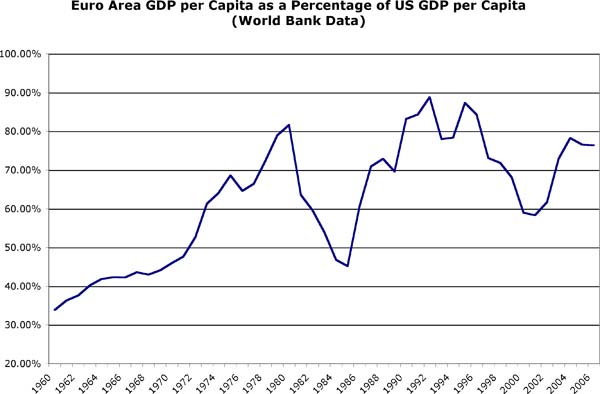

As you point out though not exactly this way: In the ensuing 25/30 years (albeit with a huge amount of US aid and supported by US-incepted institutions [is incept a verb? don’t think so…]), European real GDP per capita went from less than 50% of the US to 75% (OECD data), while they simultaneously built the social support systems that are supposed to be so debilitating to growth and prosperity. Counterarguments: It’s been stuck around 75% ever since. (Countercounter: it hasn’t lost any ground.) And, the more-rapid growth ’45-’78 is probably largely attributable to the catch-up effect–technology transfer, capital infusion, etc. But the high taxes didn’t prevent it. (Or are we suggesting that without those taxes, Europe would have kicked our asses?)

over the past 25 years the U.S. has reemerged as the acknowledged global economic leader. Economic output per person is 20 to 25 percent higher in the U.S. than in Japan and the major European economies, and the U.S. economy dominates in size and prestige.

“Has reemerged as the acknowledged global leader” is quite a statement, and I find it hard to support. (Though we obviously are and have been the leader since World War II.) By your chosen measure–U.S. GDP per capita compared to other developed countries–the results are pretty ambiguous. There have been big swings, but compared to Europe the 26-year trajectory starting in 1980 (the end of Europe’s long catch-up period) is flat:

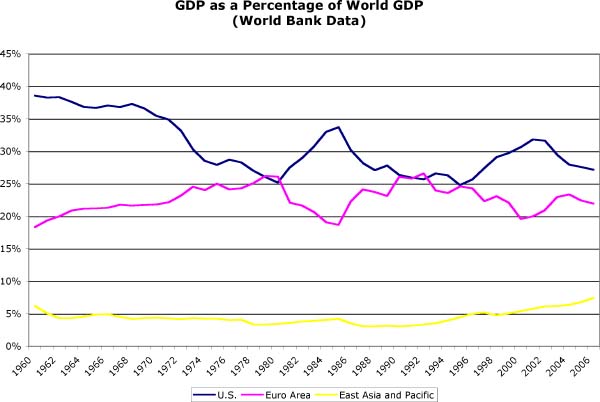

(Interestingly, OECD data shows far less volatility in this graph.) Asia’s Per-Cap GDP has never broken 4% of the US’s, but that ratio’s been skyrocketing since the late eighties. Yes, we’ve kicked Japan’s ass. But it’s hard to argue that it’s attributal to American supply-side policies…

Overall global economic dominance, as measured by share of world GDP, is also ambiguous, especially regarding presumed causes and effects:

As for growth in America’s “prestige,” check out Pew surveys. Over the last seven years at least, they show precipitous decline throughout the world. The only places where America’s president has been warmly cheered lately are in Albania (thanks to what Clinton did) and Israel.

Absolute income equality, a.k.a. communism, is a poor goal, but if inequality becomes sufficiently extreme it undermines the social support required for a democratic and capitalist society to flourish.

Right, I understand your need to put in that caveat. Nobody’s suggesting that CEOs and professors be put on collective farms.

Question: does this extreme inequality also slow long-term growth? The econometrics I’ve seen suggest a small positive correlation–barely or not statistically significant–between inequality and growth in developed countries. So it’s hard to say; I’ve seen nothing that analyzes today’s rather extreme situation, for which we have no real precedent in modern, developed economies. But looking back on the small six-figure inheritance that gave me the courage to go entrepreneurial without risking my kids’ futures (or ignominious, debilitating failure), I can’t help but imagine the power of tens of millions of naturally entrepreneurial (native and neo-) Americans given a stable springboard from which to leap. I talked about that in Wealth and Innovation: The Freedom to Do Cool Shit.

it’s generally not a good idea to keep pulling bolts from an airplane in mid-flight just because it hasn’t crashed yet.

Nice!!

The Democratic party has never assimilated the need for an increasingly market-based economy, so their “solutions” are a recipe for decline….How do we continue to increase the market orientation of the American economy

I think a better description: Democrats have never accepted the belief that all market-based solutions are a priori better, or that a headlong trajectory toward purely market-based solutions is good for the country or the world. That doesn’t mean they don’t believe in market solutions and their power to increase prosperity. Just one example among hundreds: The Pro-Growth Progressive by Gene Sperling, head of the National Economic Council under Clinton. These Democrats (count me among them) are in favor of the very kind of growth-and-equality initiatives that your article is calling for.

Your language suggests that “the need for an increasingly market-based economy” is a given, which simply needs to be “assimilated.” Given our national economic performance since 1980, a lot of reasonable people can very reasonably question whether that is a given. (Krugman gets at least one thing right:: markets “should be seen as a tool, not an object of religious devotion.”)

“Increasingly” and “increase” here, is I think the sticking point. Why not “maintain and manage”? It’s a far more “conservative” position.

A reasonable common goal: harness the natural powers of the market (the things that the market is good at) and the natural powers of government (i.e., setting and enforcing the necessary rules, and providing common goods that the market won’t provide)–an ox-team pulling in tandem. (Though they sometimes pull in different directions–that’s exactly what we want to solve by judicious use of reins and occasional whips.)

There’s no evidence that government-imposed constraints are, a priori, any worse than market-imposed constraints–any more than natural selection is in some way superior to artificial selection (i.e. breeding) just because it’s “natural.” I wrote about this in Lane Kenworthy’s Big Idea.

There’s plenty of evidence, of course, that government-imposed constraints/incentives are sometimes/often bad, at least in their sum effects. But the same is obviously true of market-imposed constraints/incentives. Enron. Moody’s! Your invocation of international institutions as one cause of America’s post-war prosperity is spot on; ditto for the SEC and the Fed, and the Consumer Product Safety Commission. (And tangentially, I’m personally very fond of the National Parks.)

As we have seen in the private economy, only markets will force the unpleasant restructuring necessary to unleash potential.

Simply not true, but it’s mainly that your case isn’t stated right. See above. See the SEC, and your SEC-like proposal for education reform. Good stuff! (And don’t get me started on schools of education–my ex-wife went to one albeit some decades ago, and described a class on “The Ten Ps of Pedagogy”: a week on Punctuality, a week on Preparedness…) It’s true that markets have far more power to effect huge change. But the government can exert the force that causes them to do so, and do things that they won’t do under their own direction.

It’s important to leave behind the knee-jerk gag reflex for regulation (while keeping a judicious eye on its net effects–and on mixed metaphors too). Planning and direction is not the same as the state owning the means of production. (“Central planning” is hate speech on the right, but we do all approve of the executive branch having an “economic plan,” right?)

Going all the way back to the comment I left on your post, I hope you’ll give real consideration to my posts on tax burden vis-a-vis growth.

Twenty-nine of the thirty OECD countries–the rich, succesful, modern economies–tax between 27% and 50% of GDP. Only four tax less than the U.S.: Greece (27%), Japan (27%), South Korea (27%), and Mexico (21%). None is exactly a model for U.S. emulation. Some of those on the high end (think: Scandanavia) arguably are.

At 28% of GDP, it’s not insane to wonder whether our current tax base has us teetering on the bottom end of the range in which a modern, stable, developed society can prosper and thrive.

If you haven’t already, take a gander at this post, where I point out that far better-credentialed souls than I agree with me regarding taxation and growth. The consensus of the data is pretty resounding: in developed economies in current taxation ranges (25-50% of GDP), tax burden and growth rate don’t correlate.

Put that shibboleth aside, and we can start having really interesting and productive analysis-based conversations about *which* taxes, how much of each, how much in total, etc.

Thanks again for writing, and thanks for listening.