The Fed data portal, Fred, just posted a blog item that I take exception to, “suggested” by Christian Zimmermann, Assistant Vice President of Research Information Services. Here’s my response.

Dear Mr. Zimmerman:

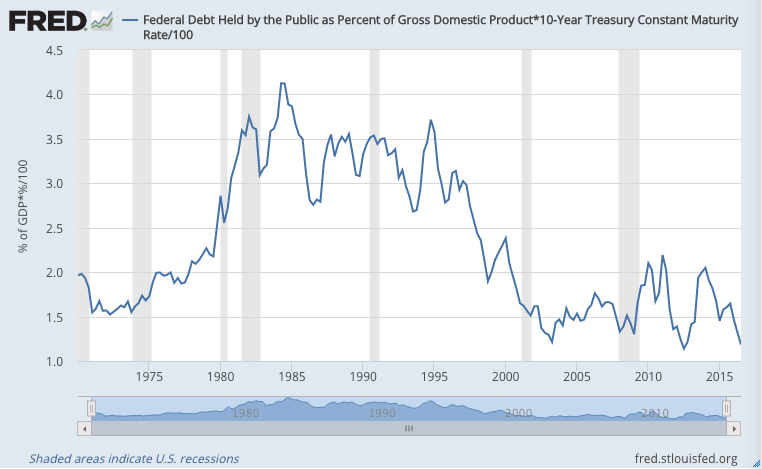

I’m pleased to see that this post focuses on the interest burden of the federal debt. It’s an important measure that doesn’t get enough attention in discussions of the subject.

But still I’m shocked by how many things are poorly represented in the post. I have no doubt you know all of this, but:

1. Public Debt (gross) is not Debt Held by the Public. (“The Public” here meaning the private sector including Rest of World.) Gross Public debt includes money owed by government to itself (SS trust fund, etc.).

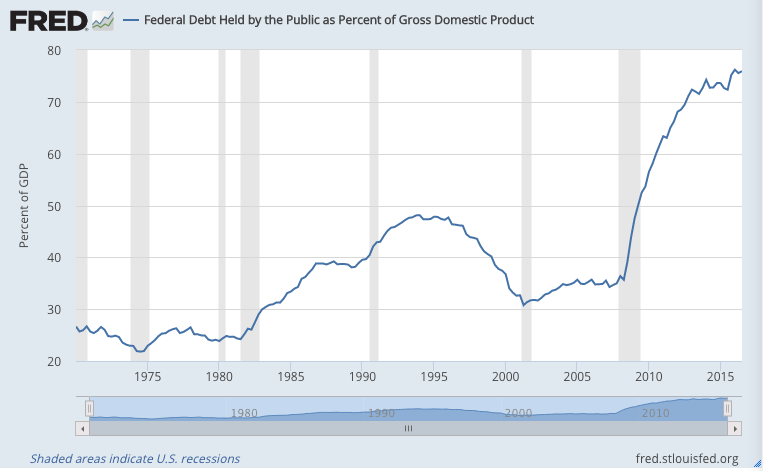

Almost every economist agrees that Debt Held by the Public, not “Gross Debt,” is the economically significant measure. Highlighting gross debt is not useful in educating the public on this subject. Quite the contrary.

This measure of course paints a very different (and less dire) picture:

2. This of course impacts the interest burden, and also paints a very different picture.

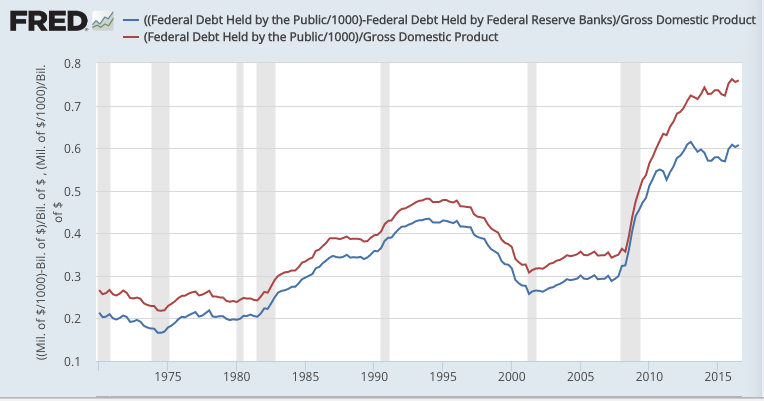

3. Even for Debt Held by the Public: Federal Reserve Banks are included in “the public” for this measure — even though their balance sheets and profits/losses redound to Treasury, IOW government, not “the public.”

Here’s actual Debt Held by The actual Public — only 60% of GDP:

One can discuss whether the Fed will ever shrink its balance sheet, and how it would do so, but this is the current condition.

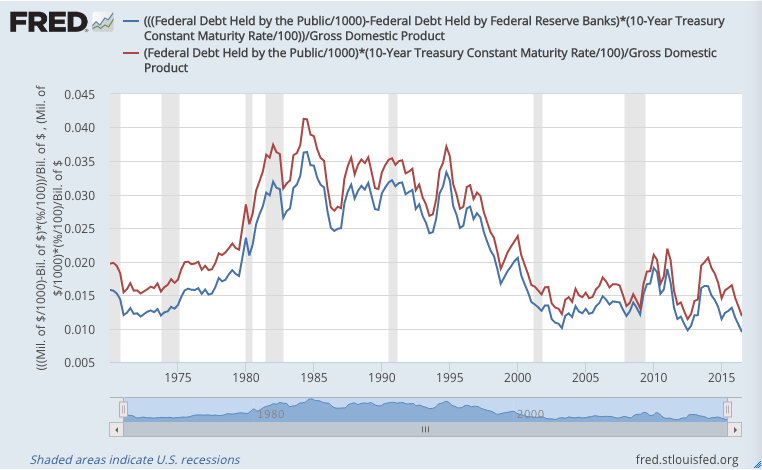

4. Again, the interest burden: Treasury’s interest payments to Fed banks on their bond holdings cycle directly back to Treasury. So true, total government out-of-pocket interest payments:

Less than 1% of GDP.

5. Circa 50% of those interest payments are to the U.S. domestic private sector, so are in no way a drain on the U.S. domestic sector.

Interest payments to foreign entities come to less than .5% of GDP.

Probably unintentionally, this Fred post contributes to the widespread “scare tactics” that result in such economically destructive fiscal decisions by our legislators.

Thanks for listening,

Steve Roth

Publisher, Evonomics