And guess what?

Saving ≠Investment. Even though it’s the fundamental “identity” of national capital accounting.

Update 2/2/2011:

It’s no wonder people think economics is confusing.

I’m being facetious. As defined, the Savings Identity is obviously true. But what is an “accounting identity”? It’s basically a definition of terms, a statement of accounting methods. And as every textbook will tell you, the Savings Identity doesn’t imply anything causative, much less normative: “if we want more savings, we should encourage investment?” Or is it vice versa? From the perspective of the Savings Identity, it’s neither.

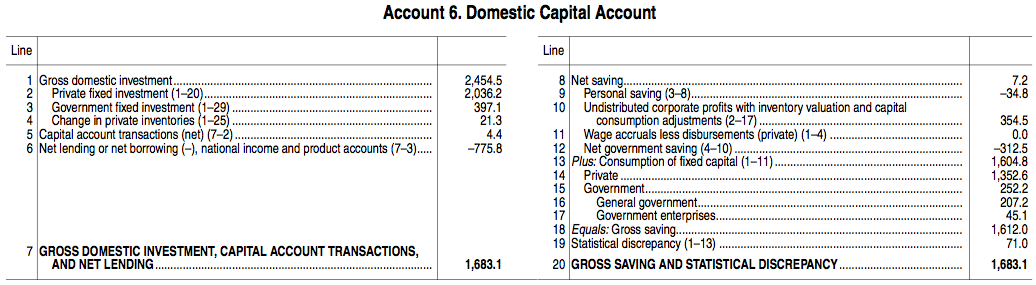

Here’s how that identity actually plays out in national accounts, here in NIPA Account 6, the Domestic Capital Account for 2005:

Sure enough, “gross domestic investment” equals “gross saving” (roughly). But this account includes international inflows/outflows (imports/exports), and government deficit/surplus. There’s also the issue of gross versus net fixed investment. (Net (roughly) = gross minus consumption of fixed capital. Plus there are some dicey considerations, not shown here, of both fixed capital and inventory valuation adjustments based on price changes, which swing things by quite large amounts relative to the totals.)

If you can parse all that in your head to deduce what’s happening in the real private economy (the flows among individuals and nonfinancial businesses), you’re a better man than I.

The Savings Identity doesn’t really relate to our vernacular usage of the words “investment” and (especially) “savings.”

In particular you’ll notice that “gross saving” has almost nothing to do with what most people imagine when they hear “saving” in the Saving Identity: private saving (by businesses and individuals). That’s only $320 billion here, out of $1.7 trillion in flows.

In the world of the individual and individual businesses — “savings” is what Stanley Kuznets (the man who created the national account system used by almost every country in the world) refers to as “money savings” or “monetary savings.” (Capital in the American Economy, p. 398 and etc.) It’s completely different from the national saving referred to in the Savings Identity.

It’s actually kind of the opposite.

What do national savings consist of? Money? Financial assets? Not even close. Fixed assets. The stock of fixed assets, the fixed capital base — which we can live in, or use to produce more stuff and services — is the very stuff of national wealth. Financial assets aren’t even included in this measure.

In Kuznets’ words:

…[fixed] capital formation…represents the real savings of the nation. (p. 391)

With that cleared up, let’s go back and look at just the private, nonfinancial, domestic sector, a.k.a. the “real” economy. Here’s what “saving” means there (roughly):

Private saving = Undistributed business profits + personal saving

Now that’s simple, isn’t it? It’s the money that’s left over, that you can put in the bank.

Here’s another, which really does encapsulate quite simply how the big flows in the real private economy work:

Income = Consumption + fixed investment + taxes + saving

There are only four things businesses and individuals can do with their income, and those are them.

You can juggle that various ways, of course:

Saving = Income – taxes – consumption – fixed investment

Fixed Investment = Income – taxes – consumption – saving

Which imparts the main point I want to make here: In the real private economy, saving and fixed investment are enemies. If you save — store money in financial assets — you are by definition not spending on/investing in fixed assets (though somebody who receives those funds might). And vice versa — money spent on fixed investment is not available for saving. This is completely contrary to the simplistic notion that most people harbor, with help from a misunderstanding of the Savings Identity.

Now of course money savings (as a stock, stored in financial assets) are useful in at least two ways.

1. They can be spent on fixed investment. They’ve got potential.

2. They serve as a buffer and store that allows people and businesses to time-shift their income and consumption/investment spending — you don’t have to spend everything as soon as you get it. (Heck, with credit you can spend it before you get it.)

A well-oiled financial system is essential as an intermediary and storehouse for those two things to happen. But that’s about all it’s good for. (Except as a market mechanism for determining prices/values, and Fama/French showed long ago that it takes very few traders to achieve an efficient market.)

To highlight that point with one more pearl of insight into the national accounts, for those who (like me) have never really understood them:

No: Price changes of financial assets do not affect GDP. (There are innumerable indirect effects, of couse — the “wealth effect,” etc.) When the stock market goes up, GDP doesn’t change a whit. Neither does “national savings” — the fixed capital stock.

In the final analysis, neither of those things is about money. They’re about stuff. (And knowledge/skills.)

The more perspicacious of my gentle readers will already be wondering: how much do we stow away in monetary savings/financial assets every year? How much do we invest in fixed assets? How big are the stocks of the two? Is there a big enough stock of money savings to fund fixed investment? Is a shortage of money savings impeding fixed investment?

Anon.

Comments

One response to “Savings ≠“Savings.” Investment ≠“Investment.” Spending ≠“Spending.””

“In the real private economy, saving and fixed investment are enemies. If you save — store money in financial assets — you are by definition not spending on/investing in fixed assets (though somebody who receives those funds might). And vice versa — money spent on fixed investment is not available for saving.”

This analysis suffers a composition fallacy. Take care when switching between what *you* can do, and what the whole economy can do.

How do you “store money in financial assets?” For example, do you buy stocks? Well, then someone is selling stocks and therefore “un-storing money in financial assets” On the whole, you two are swapping money for stocks. There is no change in the aggregate.