Cross-posted at Angry Bear.

Right-wing economists love to claim that government spending “crowds out” private spending, especially investment spending on fixed assets. It’s probably true at some level and in some situations.

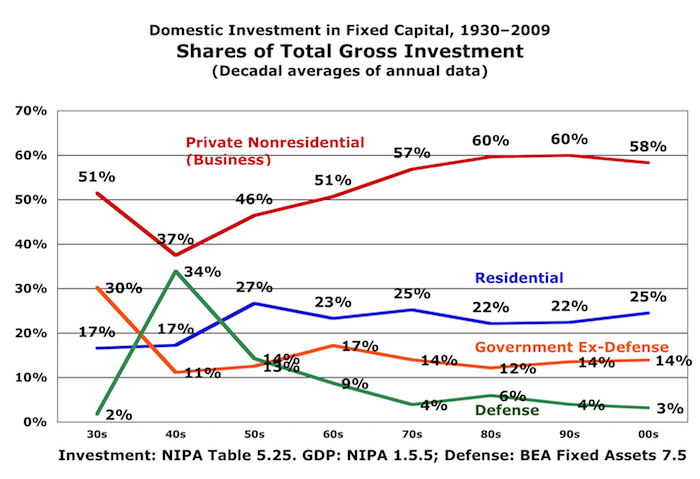

But if it was true for postwar America, you’d expect to see some evidence in the historical data, right?

Not so much:

Note: Government includes all levels — federal, state, and local.

The investment share of government, ex-defense, fell by 29% from the 60s to the 80s, while the share devoted to business increased 18% (28% from the 50s to the 80s) — the very period when the blossoming New Deal programs and Johnson’s Great Society were supposedly creating Leviathan, embodied.

Those changes in share percentages don’t really put across the magnitude of the change, though. Business investment started at a much higher level, so the absolute increase in business investment utterly dwarfs all the other changes.

Curiously (given the right-wing narrative) the business share flattened out once we started feeling the manifestly salutary effects of the Reaganomics world view. It actually declined slightly under Dubya and six years of unfettered Republican control. Go figure.

Defense investment has plummeted since the 50s (and — naturally — the 40s) — a 31% decline in its share from the 60s to the 80s, 58% from the 50s to the 80s, and 78% from the 50s to the 00s.

(Note: “domestic” assets are those located in the U.S. — except that government assets include U.S. military installations, embassies, and consulates worldwide. So this rapid decline may represent a worldwide construction binge in the 50s and 60s which was largely completed by the 70s. Defense investment generally includes much higher proportions of spending on structures — this was especially true in the 50s and 60s — compared to business investment, which devotes much, and increasingly, more to equipment and software.)

Wondering what caused Tyler Cowen’s Great Stagnation (the slowdown in economic growth since the mid-70s)? Here’s what looks like a smoking gun: Government investment spending as a percent of GDP fell off a cliff from the 50s/60s to the 80s — a 42% drop in sixteen years from ’68 to ’84, down 48% from ’58 to ’84. It’s been floating around that low level for the last 26 years.

Oh and for those who are curious, government consumption spending as a percent of GDP has been flat since the mid-70s.

The crowding-out theory of postwar America is in fact anachronistic by about six decades. When Simon Kuznets (who in the early thirties created the system of national accounts now used by every country in the world) published Capital in the American Economy in 1961, reviewing trends from 1869 to 1955, he cited the proportional growth of government investment as the dominant trend in capital formation over the decades he was examining.

The postwar trend has been in exactly the opposite direction.

I’m just sayin’: stopped clocks are wrong most of the time.

Comments

One response to “Oh Yeah: Crowding Out Has Been a Huge Problem”

[…] Oh Yeah: Crowding Out Has Been a Huge Problem Cross-posted at Asymptosis […]