Following up on some work I did a while back (Kuznets Revisited: Investment in the American Economy Since 1929), I got curious about what consumption has looked like in America over the last 80 years.

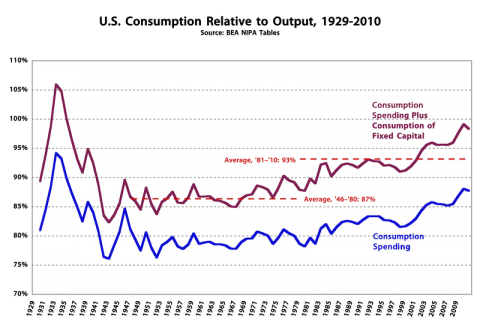

I’ll give you the results first, as a proportion of output, or GDP, followed by explanation and discussion. Click for larger.

Thinking About Consumption

This all requires some explanation. First off, when I use the word “real” herein, it doesn’t mean “inflation-adjusted.” It means real-world, nonfinancial. In national-account-speak, all consumption and investment spending is about purchases of real goods and services — things that are produced and consumed. Financial “goods” or “assets” — which aren’t/can’t be consumed by humans — aren’t even part of the accounting. (We’re “inside” the NIPAs.)

Next: when you hear economists talk about “consumption,” they’re almost always talking about something somewhat different: consumption spending. Definition: purchases, within a period, of goods and services that are consumed within that same period. (If the period you’re looking at is long enough, everything is consumption. If it’s short enough, everything’s investment — breakfast is an investment in the afternoon’s work. I’ll just talk about one-year periods here to keep things simple.)

But in any period, we’re also consuming stuff that was produced in the past, and so is not included in measures of consumption spending. We’re depleting inventories (these fluctuate up and down over the years, sort of a buffer stock), but more importantly we’re consuming real, long-term productive assets by using them, and through the inevitable decay of time (and obsolescence — a tricky technical accounting issue that I won’t explore here). When you run a drill press you’re using it up. You’re consuming it. It’s even true of living in your house. Absent maintenance and remodels, it eventually becomes a worthless heap of rotting lumber; you’ve consumed its value by living in it.

This is accounted for in the national accounts as Consumption of Fixed Capital (CFC).* (Fixed capital is broken down into equipment, software, and structures, and structures are further broken down into residential and non-residential. Consumer durables — cars and refrigerators — aren’t included in fixed capital because it would require national accountants to model households as production centers, with capital accounts.)

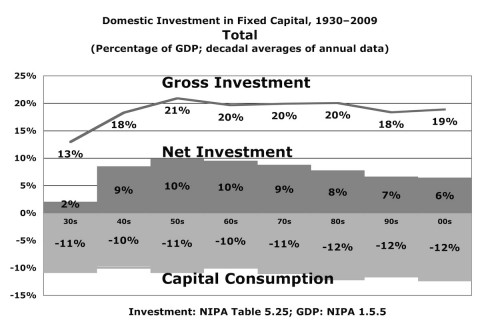

But even with that big C-word at the beginning of its name, economists rarely include CFC as part of “consumption.” In the national accounts you’ll find it accounted for as part of investment — Gross Investment minus CFC is Net Investment, or the net amount added to our national horde of fixed assets. (When you hear macroeconomists talk about investment, it’s almost always shorthand for “gross investment.”)

So: Consumption of Fixed Capital is not spending, but it is (actual, if estimated) consumption.

I was wondering how much of our real output we actually consume each year, so I added CFC to consumption spending to get what I’ll call Gross Consumption (with Net Investment being the remainder of national spending).**

Coming back to the graph, we see:

• A denominator-driven spike in these measures during the depression (GDP plummeted).

• A rapid decline in the pre-war and war years driven by 1. rising GDP and 2. a massive temporary increase in government consumption spending. (Factoid: In just seven years 1940-1947, government’s share of national consumption spending went from 13% to 39% and back to 16%.)

• A steady period of relatively low consumption from the late 40s until the mid 70s or early 80s (depending which measure you look at).

• Consuming an increasingly large portion of our national output since the late 70s/early 80s — with Gross Consumption just shy of 100% ’08-’10.

(The timing of the 70s/80s breakpoint is somewhat unclear because of the high and variable inflation of that period, which had a significant impact on estimates of capital consumption. Changed amortization and depreciation schedules, applied against the whole existing stock of fixed assets, results in significant moves.)

The depression and war years are pretty to easy to understand. What’s interesting here is the trend change since the 70s/80s. That change is not generally driven by more rapid capital consumption: that’s been pretty steady over the decades (though business capital consumption has accelerated as the capital proportions have shifted from longer-lived structures to more rapidly depreciating hardware and software):

You can see that in the first graph as well; the two lines have moved pretty much in synch.

So the long-term trend change for the nation as a whole is simply toward more consumption spending and less investment spending. That may seem obvious to some, but it’s nice to know it for sure.

It’s the same 70s/80s inflection point and secular shift that we see in so many other measures, especially various measures of economic growth (pointed out repeatedly by so many, notably on Angry Bear by Mike Kimel, moi, Jazzbumpa, and others, and serving as the impelling premise of Tyler Cowen’s The Great Stagnation).

I can think of a dozen different explanations, interpretations, and rhetorical riffs off of this three-decade trend. While most have a perjorative and pessimistic import, not all do. Perhaps we’ve gotten better at supply-chain management, so we require an ever-smaller buffer stock of real stuff relative to consumption and output. Or maybe we don’t need as much productive stuff — as it’s measured in dollar terms in the national accounts — to produce the same dollar-denominated quantities for consumption.

These strike me as pretty charitable and speculative explanations, though. The most obvious interpretation is suggested by the title of this post: we’re consuming more and more of our seed corn (and tractors), leaving less for future consumption and production (and growth). That may be true, or it may be simplistically reductive.

For the moment I’ll leave that determination to my gentle readers, and simply leave you with a long-term view of what seems to be an important and not-widely-discussed measure — Gross Consumption — describing how our economy has been operating over the last eighty years.

* I really wish they said “fixed assets” instead of “fixed capital,” because economists are so profoundly confused about what “capital” means. (Many seem to think that fixed “capital” and financial “capital” are equally parts of some synonymous, homogenous, or vaguely contiguous undifferentiated blob.) Many everyday folks are equally confused about “assets,” but most economists seem to understand at least dimly that real (or at least fixed) assets and financial assets are decidedly different things that can’t be thought about, analyzed, or modeled in the same ways. The key in discussion is to always specify what type of assets or capital you’re talking about, especially differentiating between financial and real (with fixed being a subset of real that happens to be fairly easily measurable by totting up money transactions).

** Here ignoring the trade balance for the moment; we purchase 3 or 4% more than we produce these days — part consumption spending, part investment spending — because in toto we import more than we export. Don’t be confused by the GDP = Production = Expenditures = Consumption Spending + Investment Spending = Income identity; that’s only true in a closed economy.

Cross-posted at Angry Bear.