Or: Yes, The Rich Really Are Different

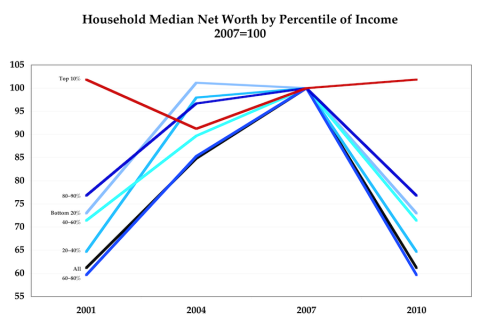

You’ve all probably seen the depressing reports from the newly issued 2010 edition of the Fed’s triennial Survey of Consumer Finance, in particular the 39% drop in median household net worth, ’07-’10.

Here’s a picture (click for larger):

The well-off have done fine. In the greatest economic downturn in eighty years, their median net worth went up.

This doesn’t even touch on the top 1%, .1%, or .01%, of course. It’s very hard to calculate net worth for those folks as a group. But judging by their incomes, they’re doing just fine too:

I can’t comprehend how anyone can play word games about “incentives” to suggest that this situation, created quite intentionally over the past three decades, is or could be conducive to widespread national prosperity.

I can only assume that those who do so don’t actually care about widespread national prosperity.

Cross-posted at Angry Bear.

Comments

8 responses to “Recessions Are Nature’s Way of Keeping the Little Guy Down”

wow, if that aint enough to make one sick. simply fucking amazing, and the country is too broke for education, public employees, social security, medicare for all. everything is so fucked up, it is hard to keep track, someone should be noting all the ways we are being screwed and constantly reminding people(oh right, american idol is on, must keep priorities)

That’s what happens when “prosperity” is redefined as GDP growth regardless of distribution. American is getting more “prosperous,” Americans by and large are not.

@Tom Hickey

Yeah I wish I could find a better single-number snapshot measure than GDP/capita for cross-country comparisons. I’d really like to use the measure here, or median household income (even better, household-size-adjusted median household income), but I can’t find international data on it — even spot data, much less long-term time series, much less broken out by income/wealth quintiles. The SCF is kind of special in the information it provides. I wish there was/had been an international equivalent for the last three or eight decades…

[…] Cross-posted at Asymptosis. […]

[…] So where are we now, with the home-price/income ratio trending up off the charts again, and even higher now? Maybe it’s just that home builders aren’t building any inexpensive homes anymore, because the people who buy those homes have been eviscerated: […]

[…] So where are we now, with the home-price/income ratio trending up off the charts again, and even higher now? Maybe it’s just that home builders aren’t building any inexpensive homes anymore, because the people who buy those homes have been eviscerated: […]

[…] Also worth noting in this graph: before the recent…debacle of 2007–2009, the median wealth of older households grew a lot, while younger households held generally steady. No age group got (much) worse off, while older groups got much better off. Sounds okay, though not stellar. The Great Whatever greatly accentuated that old-young distinction, eviscerating the median wealth of all but the aged while leaving the typical elderly household mostly untouched. (See: Recessions Are Nature’s Way of Keeping the Little Guy Down.) […]

[…] Also worth noting in this graph: before the recent…debacle of 2007–2009, the median wealth of older households grew a lot, while younger households held generally steady. No age group got (much) worse off, while older groups got much better off. Sounds okay, though not stellar. The Great Whatever greatly accentuated that old-young distinction, eviscerating the median wealth of all but the aged while leaving the typical elderly household mostly untouched. (See: Recessions Are Nature’s Way of Keeping the Little Guy Down.) […]