Discussing the failure of modern macro to incorporate the financial system into its models, Ben asks, why did the bursting of the housing bubble spank the economy so much harder than the dot bomb crash? He sez (courtesy Brad DeLong, emphasis mine):

…the decline in wealth associated with the tech bubble bursting [in 2001] and the decline in wealth associated with the decline in house prices as of, say, late 2008 was about the same–maybe even more on the [2001] stock [market] bubble. From a standard macro model or even one elaborated with financial factors, you would not have really thought that the housing bubble would have been more damaging than the stock bubble. Now the reason it was more damaging, of course, as we know now, is that the credit intermediation system, the financial system, the institutions, the markets, were far more vulnerable to declines in house prices and the related effects on mortgages and so on than they were to the decline in stock prices. It was essentially the destruction of the ability of the financial system to intermediate that was the reason the recession was so much deeper in the second than in the first.

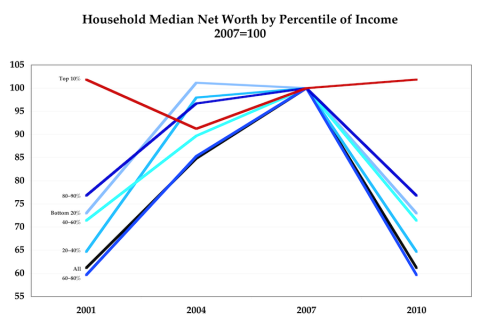

This familiar (and delusional) self-serving lionization of financial-industry “intermediation” completely misses the most significant difference between the two bubbles: one briefly dinged the wealth of a small proportion of the population — those who own stocks — while the other slammed hundreds of millions of people, permanently (click for larger):

(U.S. Census Survey of Consumer Finance)

Is it hard to imagine the effects of this picture on demand for real-world goods and services that humans consume, or the incentives for producers to invest, and produce (and sell) those goods and services?

Takeaway: if we want widespread prosperity and stability, we need a financial and political system that delivers…widespread prosperity. Pace (even) Paul Krugman, you don’t get it by making (and keeping) the rich people richer, and justifying it with the old “intermediation” rationalization.

Cross-posted at Angry Bear.

Comments

2 responses to “Bernanke (Mis)Explains the Effect of the Tech and Housing Bubbles”

I’m not sure why but this website is loading very slow for me. Is anyone else having this problem or is it a problem on my end? I’ll

check back later and see if the problem still exists.

Hi there! This is the third time visiting now and I really

just wanted to say I truley relish reading your site.

I decided to bookmark it at stumbleupon.com with the title:

Asymptosis » Bernanke (Mis)Explains the Effect of the Tech and

Housing Bubbles and your URL: http://www.asymptosis.

com/bernanke-misexplains-the-effect-of-the-tech-and-housing-bubbles.

html. I hope this is alright with you, I’m making an attempt to give your excellent blog a bit more publicity. Be back shortly.