This issue has been driving me crazy for a while, and I never see it written about.

When responsible people talk about the national debt, they point to Debt Held by the Public: what the federal government owes to non-government entities — households, firms, and foreign entities. (Irresponsible people talk about Gross Public Debt — an utterly arbitrary and much larger measure that includes debt the government owes to itself.)

Debt Held by the Public is the almost-universally-accepted measure of “the national debt.” That would be perfectly reasonable, except that…

Federal Reserve banks are counted as part of “the public.” So government bonds held by this government entity — money that the government owes to itself — are counted as part of the debt government owes to others.

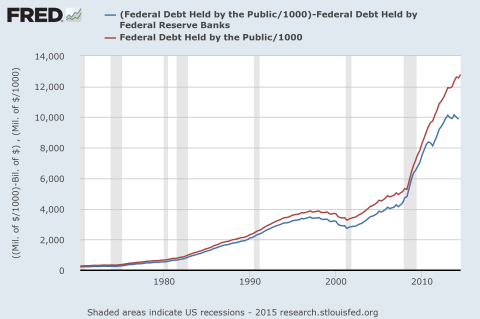

The Fed has bought up trillions of dollars in government bonds since 2008, to the point that Debt Held by the Public has become an almost meaningless measure (click for source):

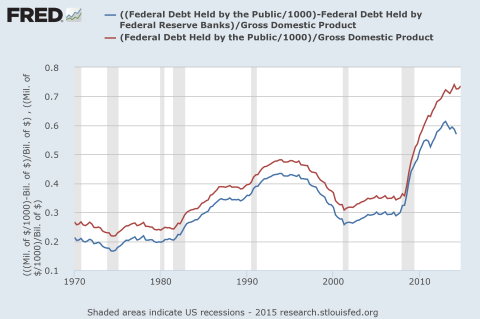

Here it is as a percent of GDP:

Debt actually held by “the public” equals 57% of GDP — and declining — not 73% of GDP.

I don’t know how economists or pundits think they can have any conversation at all about this subject, analyze it in any useful way, if they ignore this basic reality. Reinhart and Rogoff, are you listening?

Cross-posted at Angry Bear.

Comments

12 responses to “National Debt: Since When is the Fed “The Public”?”

SR,

I am not sure what you are trying to say although agree about your gross/net distinction.

If you want to bring the Fed in and uncount the government bonds held by it, you count its liabilities to the banking sector.

Feels like a free lunch, no? Fed buys 100% of outstanding govt debt and the US becomes debt-free.

So we should count as “government liabilities” fed reserves, because they could, in some imaginary world, all be redeemed for pieces of physical currency? Which would be printed essentially for free by consolidated fed/treasury?

The more pertinent issue, of course, is whether the fed will ever shrink its balance sheet (the blue and red lines reconverging), and what exactly “shrink” means in that case. Nominal? Real? % of GDP? Relative to DHBTP? As a % of (some measure of) government debt?

@effem

Or:

Just start issuing 5% bonds at a discount to replace current bonds. Voila!

That may just seem like prestidigitation, but it points out the rather arbitrary nature of “national debt” measures.

@Asymptosis

And shouldn’t we count all of Treasury’s liabilities too, like…PV of SS and medicare out to an infinite horizon?

That suggestion is not absent from the discussion among national accountants…

1. I’m not sure which people are more responsible — those who look at part of the Federal debt, or those who look at all of it. I think maybe the responsible thing is to look at both measures.

I am sure that it is not responsible to manipulate debt numbers with the apparent objective of trying to minimize them or make them appear smaller than they really are.

2. Good graphs.

There is a third data series “Federal Debt Held by Private Investors” FDHBPIN which closely tracks the difference between the series FYGFDPUN and FDHBFRBN.

I use all three series to learn how much money above-tax-revenue has been spent by government . Then, following the so called Modern Monetary Theory (MMT), I conclude that money spent by government but not yet recovered by taxes, must remain in the economy. I have a current post on the subject Macroeconomic Stimulus Leaves a Remainder

There is a wide divergence of opinion on the effects of government debt on the macro economy.

Well SR, that redeemability is a side issue.

If you want to have it that way, the US government also rolls over its debt easily. So why not count that out as well and declare that the public debt is zero.

The Fed has stopped its QE and over a period of time, reduce its balance sheet, at least that’s what the plan is at the moment.

But you wouldnt want people to quote a bigger figure later and plot graphs which showed a lower debt now and higher debt (than otherwise) later because of QE taper.

The best is just the way it is done currently.

@Ramanan “over a period of time, [will] reduce its balance sheet, at least that’s what the plan is at the moment.”

Choosing which accounting/economic measures are useful, based on predictions for the future. Often necessary. (eg. “Will those loans get paid off or not? If we think not, we should choose the measure that excludes them as an asset.”)

In privileging DHBTP, you’re predicting that the blue line will climb up to meet the red line, rather than the red line sagging to meet blue. You may well be right.

But it’s ultimately a causation question, isn’t it? To interrogate that, ask: If the red line had not climbed, would the blue line have climbed instead? “As a result”?

Different measures tell us different things.

You pretty much always say that. Did you say that when they considered counting R&D/IP, and before that government investment, as “investment”?

@Asymptosis

Well check how the BEA has updated it to SNA standards.

@Asymptosis

I am not sure what your point about lines is.

Whether or not there is QE, debt held by the central bank is counted and not ignored. I am not sure why you are always insistent on changing definitions. It serves no purpose.