Work hard. Save your money. Spend less than you earn. That’s how you become wealthy, right?

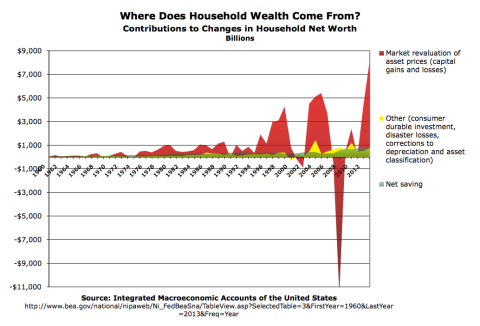

That’s not totally wrong, but if you think that’s the whole story — or even a large part of the story — you may be surprised by this graph:

(Note: these are not realized capital gains, which really only matter for tax purposes. If the value of your stock portfolio or house goes up for twenty or thirty years, you’ve made cap gains even if you haven’t “realized” them by selling.)

Household “saving” — households spending less than they “earn” — contributes a remarkably small amount to increasing household net worth. And that contribution has shrunk a lot since the 90s.

The accounting explanation is simple: “Income” doesn’t include capital gains; it comprises all household income except capital gains. So capital gains are also absent from “Saving” — Income minus (Consumption) Expenditures. (This is why HouseholdSavings1 + HouseholdSaving ≠HouseholdSavings2 — not even vaguely close.)

The capital gains mechanism appears to dominate the ultimate, net delivery of rewards to household economic actors. Earning more and spending less is weak beer by comparison.

What does this say about our understandings of how the economy works? Does economists’ fixation with “saving” provide a useful picture of macro flows in the economy? Since asset ownership is hugely concentrated among the wealthy (even real estate), can we think about the economy’s workings at all without looking at distribution? Does this dominant mechanism allocate resources “efficiently,” or deliver the kind of incentives that make us all better off? And etc.

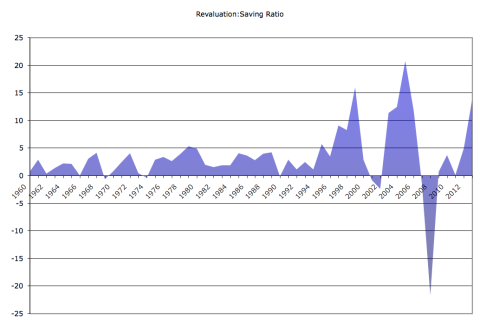

There’s much more I’d like to say about this reality, but I’ll just provide one more graph for the time being and let my gentle readers ponder the bare facts.

The spreadsheet’s here. Have your way with it. (It’s kind of messy; drop a line with questions).

Cross-posted at Angry Bear.

Comments

26 responses to “How Do Households Build Wealth? Probably Not the Way You Think. Three Graphs”

SR,

“Household “saving†— households spending less than they “earn—

Saving is not earning minus spending. Saving is earning minus consumption spending.

Of course in some places you have the definition right but it helps to keep it consistent throughout.

Of course doesn’t take away anything you have to say about data. Have to look at the numbers in detail but in India, household saving rate is quite high so what you say isn’t universal.

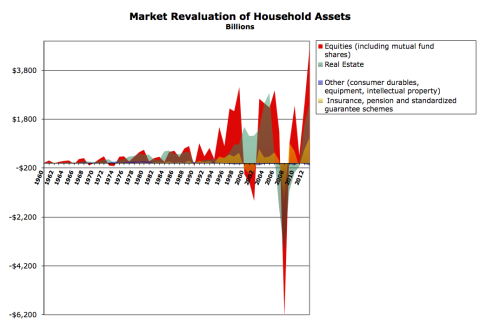

Btw how of it is due to rise in house prices?

@Ramanan

We’ve been over this. All households spending is consumption spending. (Except in the IMAs, where a tiny bit is durable goods investment.)

@Ramanan See the last graph. Details in the spreadsheet.

In any case, terminology aside, the dominance of the cap-gains mechanism was an eye-opener for me. You?

The fact that numbers are in current dollars distorts the charts a bit. I would suggest you deflate the numbers so that one can more easily look at the situation before 1980.

@Asymptosis

“All households spending is consumption spending. (Except in the IMAs, where a tiny bit is durable goods investment.)”

Yep we have been over this. The first statement is simply wrong. And it is not just in the IMAs. Plus durable goods is not really investment but house purchase is the main thing.

So households spend in consumption as well as buying houses. That the latter is typically via borrowed funds doesn’t make buying houses not spending in case you have the confusion.

@Asymptosis

I knew. In the early 2000s, there were several articles written including by a Post-Keynesian arguing that with capital gains being taken into account, households’ finances are quite good.

Looks to me like you are saying that savings, if put into the stock market judiciously (index funds?), have in the past built wealth.

Aren’t the key questions: Where do the savings go? and Does past performance work to drive savings into the “wrong” assets?

@Anon

I think a good way of saying it:

If people are to be “paid what they’re worth,” just earning and saving won’t do it. Because much of that worth doesn’t get routed into wages (or dividends or interest). It passes through the cap gains mechanism.

This suggests that a certain percentage of people who never build a nest-egg and invest long-term will never be paid what they’re worth. One could say it’s their fault, but to some greater or lesser extent it’s luck. If more of the “what they’re worth” were passed directly through the mechanism of wages, it seems like it would reward luck less, and hard work more.

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

Really appreciate this analysis — it makes me realize, though, that we transfer our society’s wealth to stocks, real estate, and other investments. It doesn’t really have to be that way – it is easy to think of ways to stop money being transferred to those who are already rich. Very interesting.

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched supervision information and found that domicile saving — whatever income people have left over after their spending — has tiny outcome on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] Investor and blogger Steve Roth recently crunched government data and found that household saving — whatever income people have left over after their spending — has little effect on boosting wealth. […]

[…] to Steve Roth, household wealth mostly doesn’t come from saving but, instead, from market revaluation of […]

Your savings number is way too low. Everyone making under $110k a year is saving about 12% of their gross wages in the form of FICA taxes, which in turn creates an accrued social security/medicare asset on their household balance sheet.