I’m thinking this headline will raise some eyebrows in the MMT community. But it’s not really so radical. It’s just using the word money very carefully, as defined here.

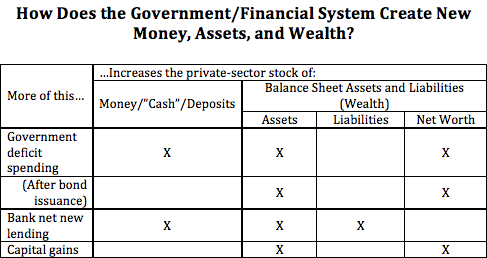

Starting with the big picture:

You can compare the magnitude of these asset-creation mechanisms here. (Hint: cap gains rule.)

The key concept: “money” here just means a particular type of financial instrument, balance-sheet asset: one whose price is institutionally pegged to the unit of account (The Dollar, eg). The price of a dollar bill or a checking/money-market one-dollar balance is always…one dollar. This class of instruments is what’s tallied up in monetary aggregates.

A key tenet of MMT, loosely stated, is that government deficit spending creates money. And that’s true; it delivers assets ab nihilo onto private-sector balance sheets, and those new assets are checking deposits — “money” as defined here.

But. Government, the US Treasury, is constrained by an archaic rule: it has to “borrow” to cover any spending deficits. So Treasury issues bonds and swaps them for that newly-created checking-account money, reabsorbing and disappearing that money from private sector balance sheets.

If you consolidate Treasury’s deficit spending and bond issuance into one accounting event, Treasury is issuing new bonds onto private-sector balance sheets. It’s not printing “money,” not increasing the aggregate “money stock” of fixed-price instruments.

This was something of an Aha for me: If you look at the three mechanisms of asset-creation in the table above, only one increases the monetary aggregates that include demand deposits (M1, M2, M3, and MZM): bank (net new) lending.

Arguably there might be one more row added to the bottom of this table: so-called “money printing” by the Fed. But as with Treasury bond issuance, that doesn’t actually create new assets. The Fed just issues new “reserves” — bank money that banks exchange among themselves — and swaps them for bonds, just changing TheBanks’ portfolio mix. That leaves private-sector assets and net worth unchanged, and only increases one monetary aggregate measure: the “monetary base” (MB).

I’ll leave it to my gentle readers to consider what economic effects that reserves-for-bonds swap might have.

Comments

2 responses to “Actually, Only Banks Print Money”

Hi Steve,

The central issue is government spending and tax *does* act very much like a bank. Imagine spedning first water cycle view VAT (UK slaes tax) as ‘cashback’ no saving in the spending chain get all the money spent back as tax.

All currency issuing governments run intraday overdrafts at their central bank and intraday repos etc. Here is the UK’s : https://publications.parliament.uk/pa/cm200102/cmselect/cmpubacc/349/349ap02.htm “Government bank accounts at the Bank of England are linked together in a system known as the Exchequer Pyramid, to ensure that any cash balances that remain at the end of each day are channelled into the main central government accounts to reduce the government’s cash borrowing needs to a minimum. If the Consolidated Fund has a surplus at the end of the daily operation this is automatically transferred to the NLF to reduce its borrowing needs. If, on the other hand, the Consolidated Fund is in deficit, for example through outflows on the day being greater than taxation receipts, this is automatically financed by a transfer from the NLF. The NLF will then borrow overnight any remaining cash deposits held in any government accounts at the Bank of England (including the accounts held by government departments at the OPG). The overall effect of this will be a net Exchequer Pyramid surplus or deficit in the NLF.”

And the US: http://heteconomist.com/exercising-currency-sovereignty-under-self-imposed-constraints/ and http://heteconomist.com/self-imposed-constraints-as-an-obfuscating-factor/

@Kester “The central issue is government spending and tax *does* act very much like a bank.”

I think that’s true in a sense. But there’s a crucial difference: Gov def spending (with or without bond issuance) increases private-sector balance sheet assets and net worth.

Bank (net new) lending increases private-sector assets, but it increases liabilities equally. Both the financial and nonfinancial sectors expand their balance sheets — with no change to net worth.

It seems there would be very different economic effects, reactions, to those very different changes in private-sector balance sheets.