If there’s one thing people would like more of these days, it’s stability. When the economy rockets up one year, then plummets or stagnates the next, it’s bad for everyone–especially those farther down the income scale, who have less recourse in face of national and global events that are completely beyond their control.

This got me wondering: over the course of decades, which is more stable–the U.S., with low taxes and limited social spending, or Europe, with it’s larger social support systems and higher taxes?

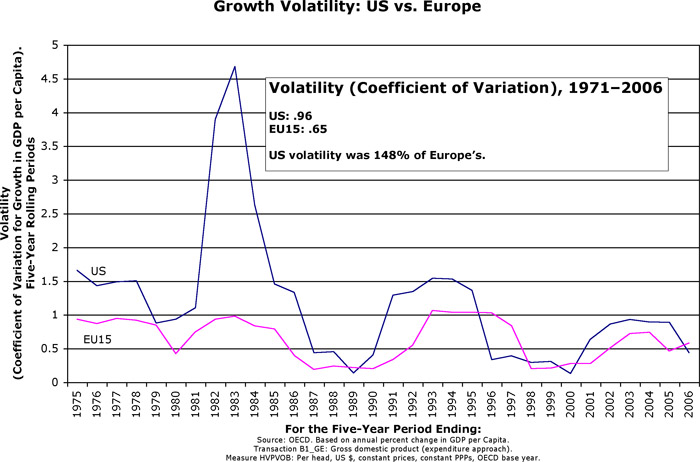

Here’s the answer, gauged by one big-picture measure–annual growth/decline in GDP per capita:

Short answer, the U.S. economy is far more volatile. In 25 out of 30 five-year periods, the EU was more stable. For the 35-year period ’71–’06, U.S. economic volatility has been 48% higher than Europe’s.

Europe’s greater stability may or may not be a result of its social policies. (Though there is good reason to think it is.) But whatever the cause, it sure would be nice to import a good-sized hamperful, if such things are exportable.

Comments

3 responses to “Ahh, for European Stability…”

It’s worth noting that most of the volatility comes from US growth exceed European growth, rather than vice versa.

It’s not that the free-market economic policies implemented in the U.S. in recent decades aren’t preferable to the European model, it’s that there’s some limit to how far you can take them (continuing to cut taxes without reducing spending, for example).

Ed: “most of the volatility comes from US growth exceed European growth”

That doesn’t seem to jibe with this:

http://trueconservative.typepad.com/trueconservative/2008/05/europe-vs-us-wh.html

But I’m not a stats whiz. Tell more?

My bad. Skimmed through the graph too quickly. Thought it was showing annual GDP growth, rather than volatility.

Nevertheless, let’s not pretend that European economic policies don’t have a cost, in the form of significantly higher baseline unemployment rates.