The megabillion-dollar corporate bailouts raining down in the coronavirus response are giving new urgency to voices on the left excoriating corporate stock buybacks. How can we pour money into these firms, even as they pump gushers of money out the other end that could be spent on hiring and investment?

Much of the pushback against that view is unabashed hippie-punching, claiming that lefties don’t understand basic finance and business. “Dividend payments drain money just like buybacks do. Why aren’t you complaining about those? And, the money distributed by either method gets reinvested in other companies. Are you saying we should eradicate shareholder corporations? Sheesh.”

Dividends do “drain” funds from firms — that’s their very purpose — so it seems like a telling question. But the finance guys claiming that buybacks are benign or even salutary (really, they’re almost always guys) merit a serious dose of punchback themselves. Because they’re foolishly (or intentionally) blind to the three big ways that buybacks are bad compared to dividend payments.

The first two are about tax avoidance. Buybacks let the top 10% of households (which own 88% of equity shares) extract cash from the firms they own, and pay vastly less in taxes than they would with dividend distributions.

When a firm distributes dividends, the whole disbursement is taxable for households. But with buybacks, households only pay taxes on their “profits,” or capital gains — the cash received for their shares, minus the shares’ original purchase price, or “cost basis.” If the firm buys shares for $25 and the selling shareholders’ average basis is $20, only $5 is taxed, versus $25 for a dividend distribution. (Dividends and capital gains are currently taxed at the same rates, much lower than taxes on earned income from working.)

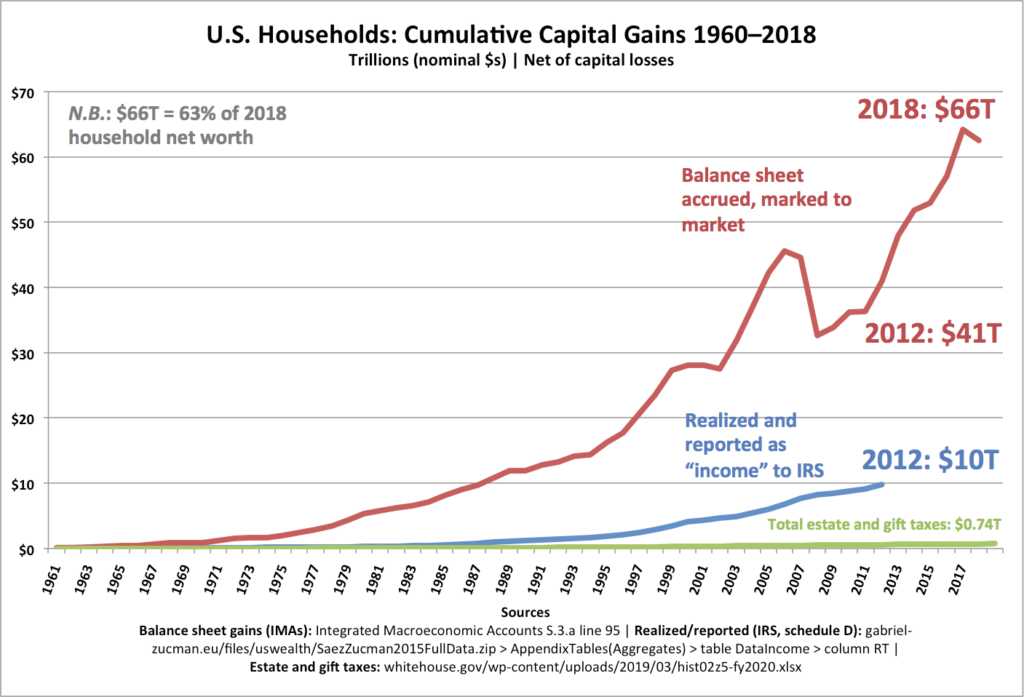

But that’s just the tip of the iceberg. Even economists and tax experts, even on the left, seem unaware that most capital gains are never, ever reported as “income.” There are myriad ways that households effectively hide capital gains (mostly, legally) and protect them from taxation — too many and too complex to detail here, but the big-picture result is eye-popping:

Combine the “basis” deduction with all those shelter methods, and those buyback disbursements are barely taxed at all — again, compared to dividends, which all count as taxable income for households.

If you think progressive taxes are beneficial, that they’re necessary for widespread prosperity and well-being, society-wide economic security, and (pas possible) even greater economic growth, this is reason enough to think that buybacks are bad. But there’s another big reason that even economic-efficientists have gotta love.

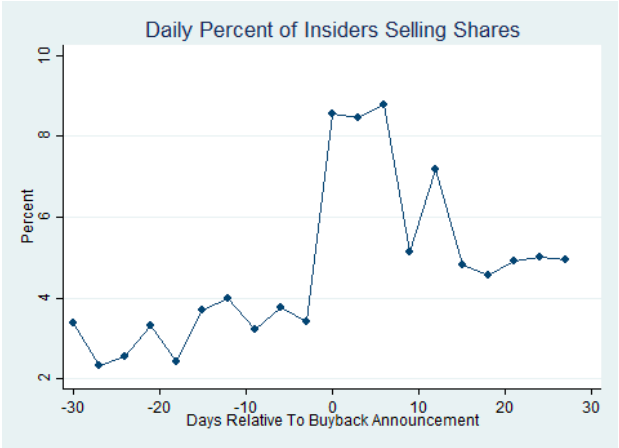

Corporate insiders know about impending buyback programs before they’re publicly announced. So they know not to sell their shares. Call it insider not-trading, something that it’s essentially impossible for regulators to regulate. Then the announcement drives up share prices, and they sell. Insiders make a nice extra buck on the deal at the expense those who sold before the announcement, and of slower or uninformed shareholders — notably buy-and-hold retirement investors and pension funds.

Here’s the the smoking gun, courtesy of Robert J. Jackson, Jr., a commissioner of the Securities and Exchange Commission.

There’s a fivefold increase in insider selling (average) from the day before the announcement, to the day of.

If the finance guys don’t know the basic economic concept of “information asymmetry,” so well explained a half-century ago by George Akerlof in his seminal “The Market for Lemons,” their fingers-twirling-in-cheeks triumphalism might be the thing that merits punching. If they do know it (uh…they do), even more so.

Remember the LIBOR scandal? Traders manipulated global markets on a massive scale with far less information advantage than this.

You’d think that this would be obvious to the finance guys — I mean, it’s what they’d do given the opportunity, right? And in fact it used to be obvious to everyone. Buybacks were illegal until 1982, treated as a violation of anti-fraud provisions of the Securities Exchange Act of 1934 — because it was assumed they’d be used for market manipulation.

But in 1982 the finance guys convinced their (ideologically?) captured regulators to gut that prohibition, with the enactment of Rule 10b-18, providing legal “safe harbor” for buybacks as long as certain conditions are met. As it turns out, the SEC doesn’t even collect the necessary data to enforce those conditions. But even if they did, the rule doesn’t touch on the crux issue: insiders knowing when to sell — and especially, exclusively, when not to sell.

Whether it’s about rules or enforcement or both, Robert Jackson’s (and others’) research makes clear that the current system is completely inadequate to prevent buybacks being used for insider trading, market manipulation, front-running, skimming, and — let’s just call it what it is — institutionalized fraud.

So sure: dividends are just as bad as buybacks when it comes to “draining” cash from firms, money that in theory could be used for hiring and investment. (Though: maybe those disbursements will be invested in other firms, which will hire and invest?) Economic progressives should stop trying to grind that “drainage” ax, first because it’s so hippie-punchable. But more so, because it misses the two giant things that are so pernicious about buybacks: they’re a decades-long, many-trillion-dollar tax dodge, and they’re a vehicle for corporate insiders to enrich themselves while fleecing everyday equity holders.

Both of those mechanisms overwhelmingly benefit the ten-percenters, one-percenters, and those far beyond. And they leave ordinary working people who are trying to build a nest egg and “safe harbor” of their own in this predatory, precarious world, as usual, with the scraps.

Comments

2 responses to “Buybacks Are Bad. But not for the Reasons You Think.”

[…] Original Post […]

Great write-up . Thanks.

Have you looked at how buybacks increase the value of executive stock options?

I’m curious as to whether the strike prices of executive options are adjusted for reduced number of shares outstanding from buybacks.

Thanks