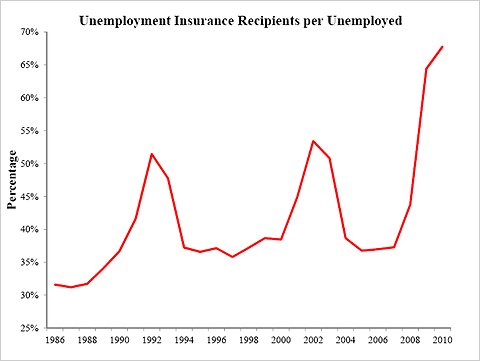

Casey Mulligan is curious: what could have caused the big uptick in the uptake on unemployment insurance in recent years?

It’s a mystery.

Or, maybe not:

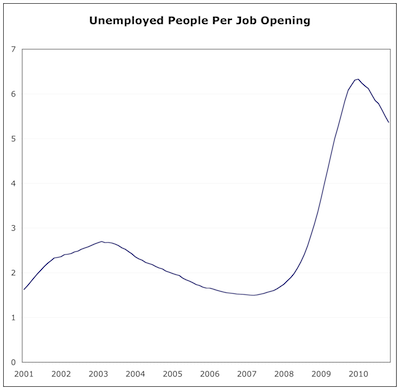

Sorry, the JOLTS data only goes back to 2001.

Which directly addresses Mulligan’s basic assertion: People are lazy. They don’t like to work.

Well yeah. (People especially don’t like working at unpleasant jobs — those at the low end of the spectrum.)

But how lazy are they?

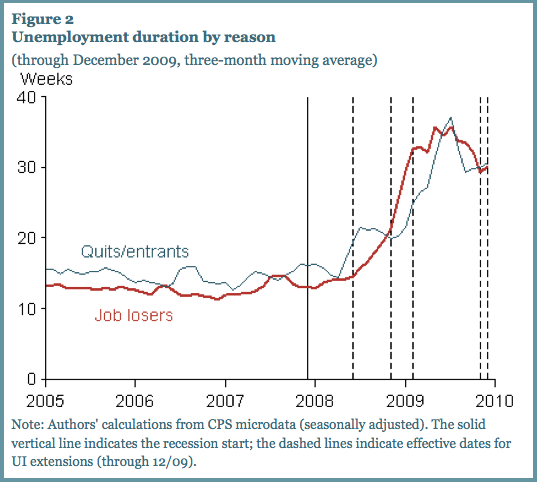

Rob Valletta and Katherine Kuang of the Federal Reserve Bank of San Francisco do a lot to answer that question. Returning here to an earlier post, on Valletta and Kuang’s study of unemployment insurance and unemployment. This graphic stands out:

People who quit their jobs or are just entering the job market aren’t eligible for unemployment compensation. People who lose their jobs are. The money quote:

The differential increase of 1.6 weeks for job losers is the presumed impact of extended UI benefits on unemployment duration. It is straightforward to translate this increase in unemployment duration into an effect on the unemployment rate, based on their proportional relationship and adjusted for the share of job losers in overall unemployment, which was about 67% in December 2009. The implied increase in the unemployment rate is quite small, slightly less than 0.4 percentage point, indicating that without UI extensions, the measured unemployment rate would have been 9.6% in December 2009 rather than the observed 10.0%.

Job losers (eligible for UIC) take an extra week and a half to get jobs.

So the “obvious” is true: if you pay people not to work, they will work less, in aggregate. Some people will opt for “funemployment” insurance and take the summer off. But that simplistic truism hides the truly important reality:

The effect is very small — even when you throw five UI extensions into the mix.

Simplistic arithmetic based on this study suggests that any given moment, because of UIC there are about 600,000 people not working, who would be working without it. (.004 times the U.S. work force of 150 million.) That sounds like a lot, and it’s certainly enough to inflame many people’s hot-wired “cheater resentment” genes.

But I say: Get Over It. They’re a tiny percentage, and in the big picture the effects are trivial. The shortage-of-job-openings effect utterly dwarfs the “laziness” effect.

Maybe my resentment genes are pathologically inoperative, but these numbers do a hell of a lot more to light up my compassion genes — compassion for the 14.4 million hard workers who are protected from personal economic meltdown, resulting from an economic catastrophe that was none of their doing. (I won’t even start on how the whole economy is better off as a result of their spending.)

If 600,000 people at a time get a week and a half of extra leisure along the way — the kind of extended leisure time that I, lucky soul, have been blessed with throughout my life — I say more power to ’em.

Cross-posted at Angry Bear.

Comments

5 responses to “Casey Mulligan Wonders Why People Use Unemployment Insurance”

Asymptosis,

You are forgetting one crucial item of information, that makes Mulligan’s argument a pure canard. That is that employers have to pay much larger premiums for their remaining employees if their laid off employees make UI claims. This will logically lead to larger receipts when large number of companies are laying off people. As employers continue laying off people, and the unemployed transition from being on UI to being counted as having dropped out of the workforce, it will appear as if the UI receipts per employed are increasing.

From California EDD’s Managing Unemployment Insurance Costs

@Clonal Antibody

Scratch the previous comment – I misread the chart.

Look at Mike Konczal’s article – What is the Real Unemployment Rate, and How Could We Tell?

One additional factor. When you have lost a job, that means you have invested a certain amount of effort into accumulating skills suitable for a specific industry. This implies that you are to some extent searching in a thinner market than an entrant. Without in any way having done the math on this, my guess is that a few extra days of unemployment to find a better match for your skills is optimal both for society and from a private perspective and has nothing to do with lazyness.

@Eric Naevdal

This makes sense to me. Ties into the notion I’ve bruited various times: it’s not just a safety net, it’s a platform and springboard. Give people a place to stand, and they’ll move the world.