James Livingston, author of Origins of the Federal Reserve System plus several other books, has been getting play lately from Megan McArdle and Karl Smith (again among others) for his new book, Against Thrift: Why Consumer Culture is Good for the Economy, the Environment, and Your Soul. (McArdle is typically daft and schmarmy.)

My longer-time readers might remember how taken I have been with some of James’ writings. (Follow Related Posts below to see some of my discussions of his discussions.) So I was pleased when he asked me to collaborate on an appendix to his book, detailing the trends in American capital formation since the time of Simon Kuznets (creator of the national accounts system in the 1930s), and Kuznets’ 1961 work, Capital in the American Economy: Its Formation and Financing.

I’m pleased to make that appendix freely available here (PDF). The spreadsheet from which the figures were generated is here.

The introductory section is all James (with a tweak by me here and there), but the data presentation that follows is all mine. I hope readers find it useful, and valuable enough that it encourages them to buy James’ book.

As a teaser to that teaser, here’s an excerpt from the appendix.

==============

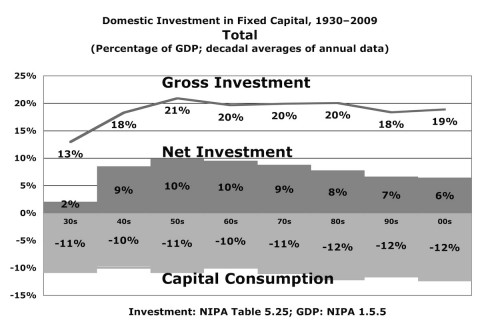

First, let’s look at total national investment in fixed

assets (Figure 1). In this graph and all the others, the depression and war

years, not surprisingly, display very large variations (the annual numbers

often jump around quite wildly). While those variations can be illuminative,

the Kuznetsian emphasis on long-term trends prompts us rather to look to the

right side of the graphs, at the postwar years that are not skewed by such

world-apocalyptic events–the six decades from the 50s through the 00s.

The most notable and consistent postwar trend is the decline

in net investment, even while gross investment remained mostly flat with slight

decline, and capital consumption increased slightly. Those two small trends

compound to result in the quite large (35%) decline in net investment as a

percent of GDP from the 50s to the 00s.

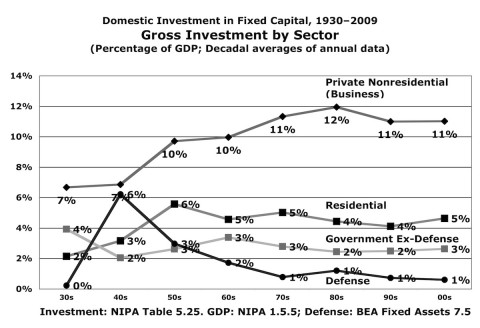

Before taking a detailed look at the sectors

comprising that total, it’s worth looking just at gross investment for those

sectors (Figure 2). The big postwar trend is the rise in the level of business

investment, and also its share of total investment–from 45% of the total in the

50s to near or above 60% from the 70s through the 00s. By contrast, in 1961

Kuznets identified the increasing share of gvernment investment as a or perhaps

the dominant trend in the decades he was examining. The long-term postwar trend

has moved in the opposite direction.

Government gross investment as a percent of GDP (not

including defense) has declined or been flat since the 50s; the decline is

significantly more pronounced if you include government defense investment.

The change in defense investment as a percent of GDP has

been an almost mirror image of business investment, declining 53% from the 50s

to the 60s alone, and 80% from the 50s to the 00s. (Since it’s so much smaller

than business investment, the smaller absolute decline yielded a far more

profound proportional decline.)

Also perhaps surprising given recent events in the

residential real-estate market, the share of gross residential investment has

been mostly flat or declining since the 60s, following a postwar surge in the

50s.

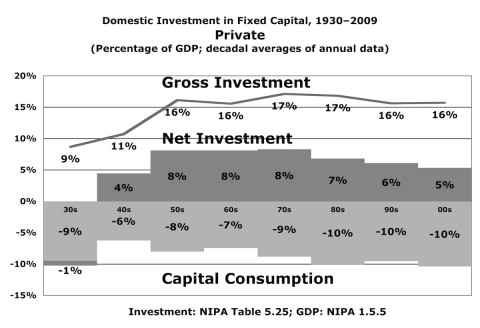

The trend for private-sector investment (residential and

non-residential, Figure 3) is similar though somewhat less pronounced than the

trend in total investment: a decline in net investment, effected by both a

decline in gross investment and a somewhat larger increase in capital

consumption.

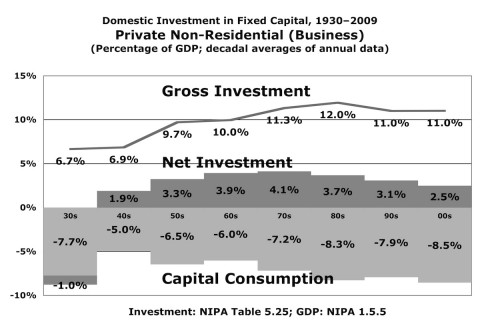

This brings us to the largest and arguably most important

investment segment: private non-residential, a.k.a. business investment (Figure

4). These assets are important because they’re used to produce other assets and

consumption goods. They are a crucial component of the national engine of

production and prosperity.

Again we see a familiar trend, but more pronounced. Gross

investment rises into the 80s and dips slightly thereafter, but net investment,

dragged down by faster capital consumption, declines significantly from the 70s

on. The net investment level in the 00s is 40% below the 70s.

….

==============

Here’s hoping you find it useful…

Comments

9 responses to “Capital in the American Economy Since 1930: Kuznets Revisited”

The trend in business investment is the reason why the developed world has been in a ‘great stagnation’ since the 70s. The Post-Keynesian argument that we’ve suffered an investment deficit since then is accurate and the data validates the thesis in most of the developed world. This manifests itself as the ‘corporate savings glut’

The cause of the investment deficit is that we have an increasingly financialised, cronyist, demosclerotic system where incumbent corporates do not face competitive pressure to engage in risky exploratory investment. A less cronyist and more dynamically competitive industry without the implicit asset-price protection afforded to it by the Greenpan/Bernanke put will have lesser profits in aggregate but more investment. Incumbents need to be compelled to take on risky ventures by the threat of extinction and obsolescence.

Lesser profits in aggregate will mean sustainable full employment and higher aggregate wages and a higher level of sustainable consumption. But it is still a stretch to argue that this sustainable level can validate the levels of consumption during the Great Moderation that were only sustained by a one-time increase in household leverage forced on households because their wages stagnated.

I have a much longer form of this argument focused more on the relationship between investment and technology adapted to US economic history here http://www.macroresilience.com/2011/11/02/innovation-stagnation-and-unemployment/

@Ashwin

And let’s not even start on a taxation system that encourages businesses to squirrel their money away in financial assets instead of purchasing real, productive assets. (And no, when I store my money by buying some government bonds from you, you do not immediately use the money to go out and build a factory, as those who misunderstand S=I would have people believe.)

[…] Steve Roth notes, business investment has been anaemic throughout the neo-liberal era. JW Mason reminds us that the […]

[…] for the Economy, the Environment, and Your Soul. That appendix and supporting data are available here. Steve has been blogging at Asymptosis since […]

[…] for the Economy, the Environment, and Your Soul. That appendix and supporting data are available here. Steve has been blogging at Asymptosis since […]

[…] up on some work I did a while back (Kuznets Revisited: Investment in the American Economy Since 1929), I got curious about what consumption has looked like in America over the last 80 […]

[…] was found by Steve Roth, who reposts what he writes to the blog Angry Bear. In December 2011, Roth wrote Capital in the American Economy Since 1930: Kuznets Revisited, and reported what he had found: The most notable and consistent postwar trend is the decline in […]

[…] for the Economy, the Environment, and Your Soul. That appendix and supporting data are available here. Steve has been blogging at Asymptosis since 2004. He’s also a self-described and variously […]

[…] for the Economy, the Environment, and Your Soul. That appendix and supporting data are available here. Steve has been blogging at Asymptosis since 2004. He’s also a self-described and variously […]