Below are three that I haven’t seen before. Check out the rest.

Takeaway:

The Darwinian struggle to strip the flesh from insolvent consumers before one’s competitors do so is not a thriving economy nor a growing economy; it is a hollowed out economy at a dead-end of financialization and substitution of Federal debt for actual production.

I’d only amend, so: “substitution of private and government debt…” The private runup utterly dwarfed the government runup, and since private debt actually has to be paid back, that’s where the problem arises.

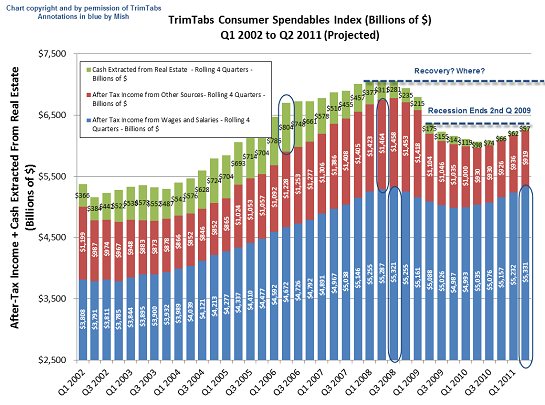

In the heyday, home equity extraction — borrowing — was adding $2.5 trillion a year to household spendables — something like 20% of GDP.

Hat tip to Zero Hedge.

charles hugh smith-The Last Refuge of Wall Street: Marketing To Increasingly Insolvent Consumers.

Comments

2 responses to “Financialization and the Stripping of the Middle Class, in Twelve Graphs”

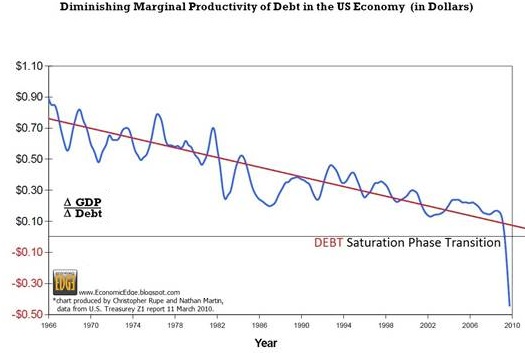

Your second graph there, change in GDP relative to change in Debt, I have a special fondness for that ratio. Grandfather Hodges is all over it. Ron Robins at Enlightened Economics has a good article on it. And The Economist had a special report on debt a while back (24 June 2010)

where they looked into “US GDP growth in $ per additional $ of debt”. I captured their graph. Good thing: I don’t find it anymore at the original site.

Thank you for the amendment. That’s a key point.

I knew Art would love graph 2.

Cheers!

JzB