Justin Fox has pointed out tellingly that not only was Q3 GDP growth overstated–it’s already been revised from 3.5% (annualized) down to 2.8%, and is likely to be re-revised again some more (downward, of course)–it also includes some profound anomalies regarding corporate profits.

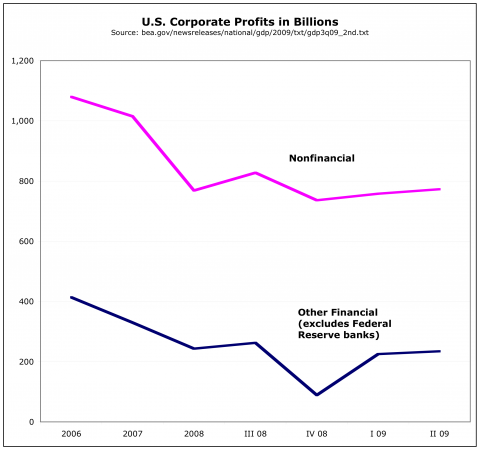

In short–surprise!–it’s the financials that are doing all the moving and “improving.” And we know where their “profits” are coming from. (Got a mirror handy?) Corporate profits by nonfinancial companies (you know–the ones who make things and provide real services) are still down, and essentially flatlined.

Here’s what’s those profits look like in nominal terms (excuse the wacky temporal scaling–it’s how the BEA provided the basic data and you can still see what’s happening):

But this gives an even better picture:

Profits for the financials have gone up 258% since Q4 (after dropping 78%).

Profits for nonfinancials have gone up 5.5% (after dropping 22%).

Who you gonna believe?

Comments

One response to “GDP and Corporate Profits: Smoke and Mirrors?”

[…] (or so-called profits) for U.S. financial companies have gone up 258% since Q4 2008, while profits for nonfinancials have gone up […]