This Twitter thread between Ryan Cooper and Joe Wiesenthal prompts me to do full-spectrum explanation of some thinking that I’ve been meaning to get to for a while. (Thanks for the inspiration.)

This is good from @ryanlcooper on why taxes are too low. https://t.co/opACPlEX5e

— Joe Weisenthal (@TheStalwart) October 25, 2017

Though I'm not sure about this loanable funds argument. pic.twitter.com/t7p2yuW69d

— Joe Weisenthal (@TheStalwart) October 25, 2017

yeah, @asymptosis has some interesting thoughts on that I haven't been able to process properly

— ryan cooper (@ryanlcooper) October 25, 2017

What follows is very unorthodox thinking even among the heterodox. It’s well beyond and different from MMT’s utterly convincing takedowns of “loanable funds” notions, for instance.

So take it as the ravings of an internet econocrank, if you will. But here it is FWIW.

First off, nobody can ever point to these so-called “loanable funds, or mostly even say if they’re talking about a stock measure or a flow measure. It’s one of those unmeasurable, actually dimensionless, concepts that econs are so fond of, like demand and supply (desire and willingness).

It’s often used synonymously with “savings” with an “s,” at least implying some stock. (The national accounts use the term “saving”; there is no stock measure labeled “savings” therein.)

The only measurable stock of “loanable savings” I can think of is wealth: balance-sheet assets, or net worth. (The national accounts, by the way, only started tallying those comprehensively a decade ago.) Household-sector assets or net worth are probably the best measures of this, because they incorporate the value, telescoped in, of the household sector’s wholly-owned subsidiary, firms.

On the idea that household saving “funds” lending and investment by providing more loanable funds: individual saving increases your assets/net worth. It doesn’t increase our assets/net worth. Your savings are just held in your account instead of — if you spend — someone else’s account. They can be intermediated into investment from either account.

Likewise “saving” by firms — retaining earnings instead of distributing them to shareholders as dividends. In either case those funds are in accounts that are intermediated (and re-re-re-“hypothecated”…) by the financial system. If a firm uses those funds for actual, real investment, that’s…spending! (“Investment spending” as opposed to “consumption spending” — the two sum to GDP.)

Individual saving doesn’t create any extra “loanable funds†— stock or flow. When you eat less corn (save), we have more corn. When you spend less money, we have no more money. Spending — even “consumption spending” — is not consumption. Transferring an asset (spending) doesn’t “consume” that asset, make it disappear. This error of composition pervades economic thinking. Think: Krugman/Eggertsson’s whole “patient savers”/”impatient borrowers” construct. Individual saving doesn’t create collective savings.

Individual saving is actually a non-flow, an accounting residual of two actual transaction flows — income minus expenditures. (Though it is a flow measure as opposed to a stock measure — it’s measured over a period, not at an instant.)

Sectoral saving actually consists of two (or three) things, as revealed by the accounting derivation in the Integrated Macroeconomic Accounts (IMAs): capital formation + net lending/borrowing + capital transfers. For households, capital transfers is mostly estate taxes; it’s a small number. Capital formation is the creation of actual new (long-lived) stuff within a sector, whose value is posted to the asset side of balance sheets. Net lending/borrowing is the accumulation of claims against other sectors’ balance-sheet assets.

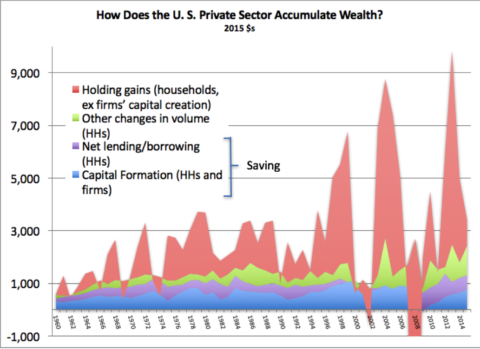

These two are utterly distinct and different economic mechanisms, crammed together into a single accounting measure labeled “saving.” It’s no surprise that nobody understands saving. In the grand scheme of wealth accumulation, these two saving mechanisms are pretty small change. Here, the derivation of change in private-sector net worth, again from the IMAs.

Real investment in the creation of newly produced, long-lived (productive) stuff — capital formation, investment spending — is overwhelmingly “funded” by churn within wealthholders’ $100-trillionish portfolio. Sell treasuries, buy into an IPO or a real-estate development deal. A zillion et ceteras. The “flow” of saving is small by comparison.

At the macro-est level, that “investment impulse” is driven by collective portfolio preferences, the markets’ risk/reward/yield calculations. (“Jesse Livermore” delivered the Aha for me on this; his measure of equities as a share of outstanding financial assets on Fred here. Pace market monetarists, it sure doesn’t look the market is crowding into “safe assets.”)

Swapping checking-account deposits for Apple shares is not investment in the economic sense of paying people (spending) to create new long-lived (productive) stuff. Collectively, it’s just portfolio allocation. If people are (confidently) optimistic, they bid up risk assets, expanding the total portfolio (wealth) pie.

Monetarists’ obsession with financial instruments like checking and money-market deposits whose prices are institutionally pegged to the unit of account (“cash” — only about 5% of household assets) blinds them to that collective portfolio adjustment mechanism. If government deficit-spends $100 billion in cash onto household balance sheets, the market is overweight cash (if portfolio preferences are unchanged). It re-allocates by competitively buying variable-priced instruments (bonds, stocks, land titles), driving up their prices. There’s more cash and more other assets.

Market asset pricing doesn’t — can’t — influence the total stock of fixed-price, UofA-pegged instruments. Their prices are fixed! (That’s the thing that makes cash, cash.) They can only be created by bank lending and government deficit spending (see next para). Those instruments are largely just a pool of intermediates in portfolio churn, in any case: sell treasuries, get cash; swap cash for IPO shares. As long as there are enough “cash” instruments for transactions to clear (and the peg holds), you’re cool. The transaction system doesn’t bind up. Collective portfolio reallocation is almost all via price changes in, duh, variable-priced instruments.

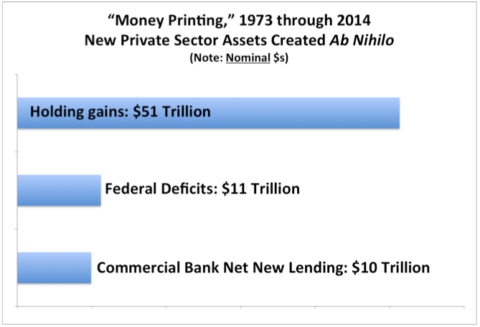

There are three economic mechanisms that create new private-sector balance-sheet assets ab nihilo: government deficit spending, bank lending, and asset-market price runups/capital gains. (Bank lending creates simultaneous private-sector liabilities, so it doesn’t create new private-sector net worth; the other two do.) These mechanisms create new “loanable funds” a.k.a. wealth. (Fed asset purchases with newly-“printed” “money” — reserves — create no new private sector assets or net worth — they just swap reserves for bonds, changing the private-sector portfolio mix; the market then adjusts its portfolio allocation in response, as described above.)

Of these three ab novo asset-creation mechanisms, capital gains utterly dominates:

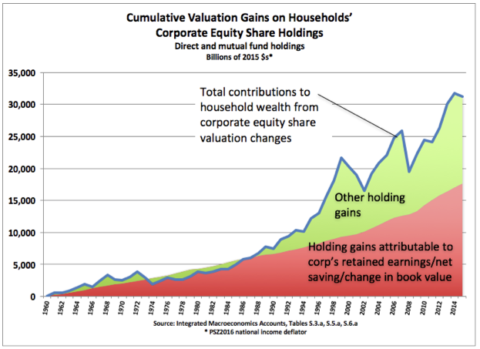

Especially since the 80s/90s, as revealed here in corporate equity performance (this in inflation-adjusted dollars):

Think Amazon: essentially zero profits, saving, change in book value over two decades, while delivering half a trillion dollars onto household balance sheets.

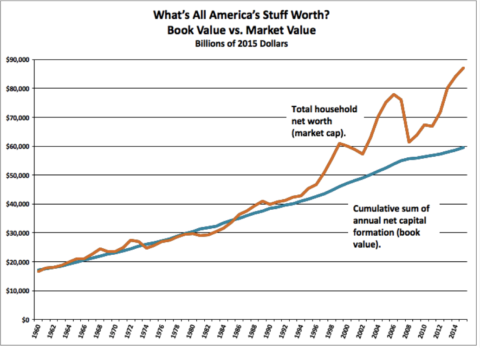

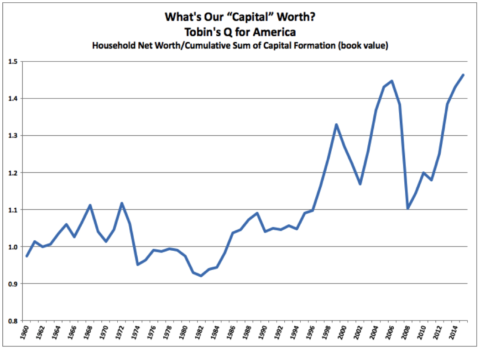

This (plus similar or larger cap gains effects in real-estate valuation) gives rise to some very perplexing trends — perplexing for me at least:

This depicts what Sri Thiruvadanthai calls a “structural break,” some kind of seeming phase shift in how markets are working, or how we perceive and report on those markets, in accounting terms. Or both. Earnings and P/E, for instance, are becoming increasingly problematic as predictors of total return. What’s the capitalized present value of future cash flows from a firm that…will never deliver any cash flows/”profits”?

The asset markets seem to think that all our stuff is worth a lot more than it sold for in the new-goods markets.* One of those markets is getting prices “wrong.” Either this is the mother of all multi-decadal asset bubbles, or we’ve been vastly understating GDP for decades. (Or something else, maybe accounting, measurement-related.)

The creation of real, long-lived goods (“capital”) is the ultimate driver of wealth accumulation. But the economic mechanisms of wealth creation and accumulation — creating new claims on all our goods and future production (claims whose market-priced value is tallied up as balance-sheet assets) — are something else entirely.

In any case I agree with Joe: within what I think is a great article, Ryan’s rather rote recitation of standard-issue “loanable funds” truisms merits some careful rethinking.

===============

* The national accounts don’t even come close to tallying all that “capital,” by the way, or the investment in creating it. Consider the massive, lasting productive value, for instance, of widespread knowledge, skills, and abilities imparted through education and training and deployed over lifetimes, or broadly experienced health and well-being delivered through health-care spending. Those expenditures aren’t tallied as “investment” (spending on long-lived goods), nor are the resulting “assets” depreciated as humans age, sicken, and die.

Comments

5 responses to “The Mysterious Stock of “Loanable Funds—

A few possibilities:

1) US asset values increasingly reflect foreign gains (there would have to be an offset somewhere – countries with asset values below “actual capital”).

2) This is an artifact of monetary policy. Central Banks push wealth/gdp to an extreme to generate demand. Once demand kicks in, asset values “normalize.”

3) The steady fall in interest rates has created a “discount rate effect.”

Really good analysis! Thanks

Hi Steve, it was good to meet you at the conference. I’m always interested in your stuff; I think a lot along the same lines.

2 things I would like to mention in this regard, not sure if you would find them relevant or not:

1. The 3rd type of wealth creation– holding/capital gains– is different from the other two types of wealth creation in that it takes one of the other to types in order to realize that wealth into cash. It can; however increase the income of the asset holder as rents increase.

2. Fully accepting the MMT critique of loanable funds and agreeing that individual savings do not increase the overall stock of savings, it’s worth noting that individual savings can help increase the stock of overall savings when an individual saver leverages that savings. For example when an individual saver of 10K leverages into a 100K house that was previously owned with cash.

Dave G

It’s good to see an economist talking about the economy in a way that makes sense from an accounting point of view. I never understood how investment could equal saving, as some macro-economists asserted, when investment was spending, but saving was not spending. The word “saving” is overused and rarely means what the speaker or writer thinks it means.

A good way to think about rising asset values, e.g. of money losing companies, is to think in terms of inflation. When the economy was tilted to the demand side, inflation tended to appear in things that ordinary working people would buy like fuel or food. Now that the economy is tilted to the supply side, inflation appears in things that extremely wealthy people buy like shares of corporations or paintings by Leonardo da Vinci. It’s the same phenomenon, just as practiced by people with different sums of money at their disposal.

@Kaleberg

Yeah it’s weird how much wealth accumulation now arises from cap gains rather than things labeled income/saving/profits. Amazon being the poster child, of course: essentially zero profits over 20 years, but it’s delivered half a trillion dollars onto household balance sheets.