Amongst all the ruckus generated by the Cox and Alms’ piece in the NYT about consumption versus income inequality in the U.S., Lane Kenworthy has pointed out that they’re both utterly dwarfed by wealth inequality:

It sure doesn’t seem fair. But if that level of wealth inequality creates greater economic growth for all, we shouldn’t complain, right? All boats rise.

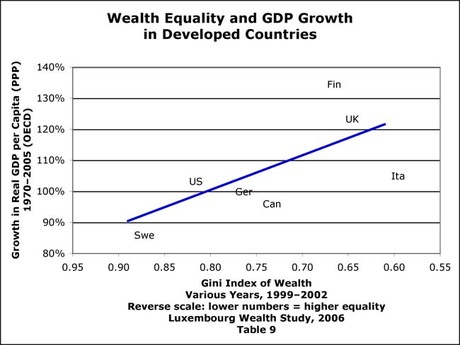

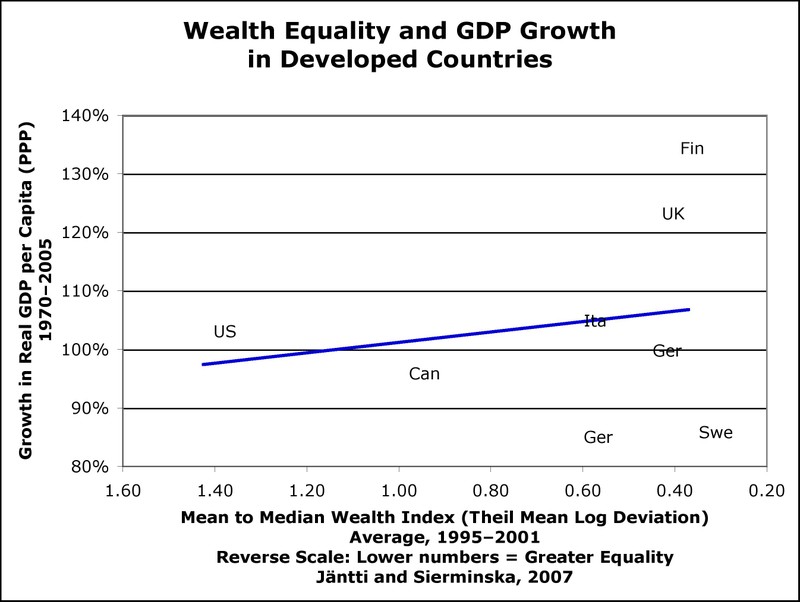

So, does wealth inequality spur economic growth in developed countries? To answer that, we really need to look at a bunch of developed countries, over as long a period as possible. Unfortunately the comparative data is pretty sparse. But here are some top-level results based on two recent studies that attempt to compare household net worths in different countries. Caveats and considerations follow.

The short (and not very complete or certain) answer is “no.†Greater equality in household net worth correlates with greater prosperity.

But it’s never that simple, is it? Starting from the top:

Data Sources. The OECD GDP data is quite good by most every economist’s standards. The wealth studies are much less so. Neither includes many countries. Both present themselves as being quite tentative first stabs at developing this information. Both cull their data from multiple and diverse sources, rather than a single consistent study. Both use various techniques to regularize it. The Luxembourg study gives every impression of being the more authoritative of the two. Read them here and here (PDF) and judge for yourself.

Besides obvious wild differences in the studies’ results (check out Sweden), the overall correlations point in the same direction. The Luxembourg correlation is remarkably robust–.67. With seven countries represented, it has a p of .05 (a 95% chance that this is a real correlation, not a result of random chance). The Jäntti and Sierminska correlation (.19) may be smaller (and nonsignificant) because the underlying data is quite literally more random.

Blatant Misrepresentation. By me. Eagle eyes will have already spotted the discrepancy between time periods. Wealth indexes for the ‘90s and ‘00s, and a growth period going back to 1970. Not exactly post hoc ergo propter hoc. The table below shows a potentially very different (and very interesting) story.

In my own defense, wealth inequality seems to change very slowly. It’s barely changed (see Table 2) in the U.S. in the last 25 years. So recent wealth equality measures may give a perfectly good representation of past decades’ conditions.

Long-Term or Short-Term Growth? Here are the results that are both confounding and fascinating: correlation between wealth equality and growth, for growth periods ending 2005 and beginning:

. LWS J&S

1970 .67 .19

1975 .58 .00

1980 -.11 .01

1985 -.22 .10

1990 -.68 -.22

1995 -.38 .00

2000 -.44 -.13

LWS shows a darned consistent trend (with one outlier), J&S the same direction but much less consistent and with smaller correlations, again suggesting possible randomness.

It will take a better statistician than I to draw any strong conclusions from this, but it looks to me like wealth equality correlates with significant economic growth over the long term, and with slow growth in the short term. (Causation is another matter entirely.)

Comments

9 responses to “Wealth Equality and Prosperity”

[…] between wealth equality (Luxembourg Wealth Study) and growth in GDP per capita over 35 years is .67. It’s damned rare to see a correlation that profound in the social […]

[…] pointed out before that wealth equality correlates strongly with greater prosperity, especially over the long term. Give tens of millions of Americans a place […]

[…] and Cox presented so persuasively recently in the NYT. (Nor does it address the far more disparate wealth inequality.) That piece seemed to be arguing that nobody’s really suffering much, so we should just stop […]

[…] pointed out in a previous post that 1) wealth inequality is extreme in America, dwarfing both income and consumption inequality; […]

[…] Steve Roth: Wealth Equality and Prosperity […]

[…] wealth to the top. It’s an “emergent property” of the system. And as we’ve seen, greater wealth inequality (at least in prosperous countries, postwar) results in much slower […]

[…] equality and long-term growth either correlate positively, or have no significant correlation. (My rather amateurish analysis of the Luxembourg Wealth data suggests a quite strong correlation between wealth equality and […]

[…] of whom are reading this.) But excessive inequity hurts the rich too, in the long run, because it kills long-term national prosperity. Economically efficient policies that deliver greater equity also deliver greater long-term […]

[…] of whom are reading this.) But excessive inequity hurts the rich too, in the long run, because it kills long-term national prosperity. Economically efficient policies that deliver greater equity also deliver greater long-term […]