Regular readers will remember my posts comparing prosperous countries — tax rates versus prosperity and prosperity growth — and will remember that they’re largely uncorrelated: lower taxes don’t correlate with faster economic growth. (See Related Links at the bottom of this post for much more.)

But what about states? Are low-taxing states more prosperous?

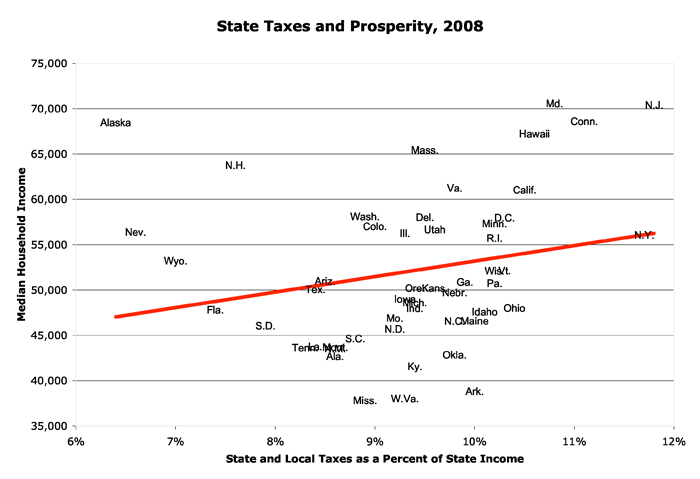

I decided to take a look at tax burdens compared to median (read: middle-class) household income. It’s a good measure of widespread prosperity, which is what The American Dream is all about. Here are the results:

Higher taxes, more (widespread) prosperity. The correlation is .22.

Is this statistically significant? The two-tailed p-value is .12, meaning there’s an 88% chance that something is causing this correlation. There’s only a 12% chance it would happen by chance.

Does this mean that higher taxes create greater prosperity? That would be quite a leap. But nothing here contradicts that possiblity.

We can say this, though: the numbers we’re looking at here give absolutely no evidence that lower taxes results in greater prosperity.

If anything, the opposite is true.

(While I’m here I can’t resist pointing out the one big outlier: Sarah Palin’s Socialist Utopia of Alaska up there in the northwest — thanks to its redistribution of oil revenues.)

median income: http://www.census.gov/prod/2009pubs/acsbr08-2.pdf

taxes: http://www.taxfoundation.org/files/f&f_booklet-20100325.xls, tab 2

Here’s the spreadsheet: http://www.asymptosis.com/wp-content/uploads/2010/08/state-median-income.xls

Comments

4 responses to “Are Low-Taxing States More Prosperous? No. QTC.”

Alternatively, taxes are higher because there’s more income to tax.

@Chris T

Of course. Presumably taxes are not a normal good, but government services might be. So hey: if so, it’s the government, instead of the private market, giving people what they want, right?

In any case there’s no evidence here that higher taxes (within the taxation ranges existent within states) reduce prosperity.

Surely you should be plotting taxes as a percentage of median income versus median income to work out if higher taxes increase prosperity? Your analysis refers only to the sources of funding of government, not to the levels of taxation.

@Chris “Surely you should be plotting taxes as a percentage of median income”

Chris, there are endless data sets that could be plotted, and endless ways to plot them. More is better — once you see enough of them you can hold up your human-judgment thumb and squint, figure out what it makes sense to believe.

I’d be really happy if you’d do the plot you suggest (you can start with my spreadsheet), love to see the results. I’m always curious, trying to feed more input to my judgment…