I’ve asked my good friend Steve many times over the years to explain the graph in my previous post:

How can he rant on so much about federal debt while continuing to champion policies that seem to have resulted in a stunning, spectacular thirty-year runup in federal debt (except under Clinton), as compared to a 35-year post-WWII decline in debt, mostly under Democrats?

One time his answer was “it doesn’t matter; I don’t care.” Other times he just didn’t answer. And he definitely never answered in writing.

But he did give an explanation over drinks the other night that gave me pause:

That runup in debt was a result of a “time bomb” left by the Democrats who created Social Security, and — especially — Medicare and Medicaid.

And now, as I’m writing this post, I’m delighted to find that he has answered in writing.

There’s a very long blog post below showing entitlement costs over the years, and demonstrating that at least 75% of Reagan’s debt increases had nothing to do with entitlements. (It’s mainly a matter of deciding which spending you want to blame the deficits on, and assuming that insufficient revenues had nothing to do with it. But at most, 25% of his debt runup was entitlement spending. The rest he managed on his own.)

But I want to cut to Steve’s key paragraph:

the big bills will kick in long after you’ve left office, and with any luck at all, you’ll likely have an army of bloggers [thanks for the link love!] who will blame it on the ideologically incompatible leaders who come after you.

Bold italics mine.

“Ideologically incompatible.” I’d say that’s true. When they put those entitlement programs in place, with enthusiastic (and ongoing!) support from a large percentage of the American people, the Democrats had every intention of paying for them. And as you can see from the debt graph, they did so, responsibly and consistently (as did Dwight D. Eisenhower, Richard Nixon, and Gerald Ford).

But I guess Reagan and his dee-sciples have an ideology that doesn’t involve paying your bills. When they came into office, those entitlement programs were the law of the land, and had been for 15 to 45 years. They weren’t going anywhere. The American people didn’t want them to. And — you’ll notice — they haven’t.

And the projected costs were clear. A responsible leader would plan to cover those costs.

But those elitist leaders knew better than the American people. They knew that those entitlement programs were bad for the people (they were certainly bad for all the people they knew). And since they knew they couldn’t convince the American people to understand their god-like wisdom and cut the spending for those programs, they’d have to do it another way. They couldn’t possibly just establish a tax regime that payed for the services the people wanted.

“Ah,” you’ll say, “but the tax increases would have had to be MASSIVE, to cover the GARGANTUAN promises made by those profligate Democrats!” (Did I mention “sky is falling”?)

Uh, not so much. If tax revenues had been only 6% higher from 1981 to 2009 — 17.7% instead of 16.6% of GDP, an extra 1.1% –– we would not have added a single nickel to our debt over those 38 years. And we would still be the lowest-taxing prosperous (large) country in the world (excepting Japan — that hotbed of economic growth).

A few more fractions of a percent, and our then-existing national debt would have been paid off long ago. We’d be sitting pretty into the foreseeable future. Sad thing we didn’t do that.

Here’s the spreadsheet. Goal-seek it yourself.

And here’s what I want to say: True conservatives pay their bills — especially when you’re only talking one penny on the dollar. How dare these people call themselves conservatives?

It’s actually mind-boggling to hear entitlement programs described as “time bombs,” when we’re in the midst of defusing George W. Bush’s utterly intentional and shamelessly transparent Monster Bomb: the supposedly “expiring” tax cuts — the most audacious, despicable instance of budgetary chicanery and legerdemain since Stockman’s “Rosy Scenario.”

All that said, here’s the post that I was writing.

In writing this post I also realized that there are two key issues to grasp in understanding our disagreement:

1. Steve is talking about unfunded future liabilities, and I was asking him about past cash flows. A lot of our disagreement stems from cash versus accrual accounting. I’m absolutely right about entitlements’ minor role in the Reagan/G.H.W. Bush debt runups. He’s absolutely right about the long-term future impact (and I’ve never disagreed on that; it’s obvious from the numbers and from everyone’s analysis of the numbers).

2. Medicare and Social Security don’t just do spending, so fixating on spending is missing the real picture. They’re funded (in large part) by tax revenues.

Social Security has been steadily cash-flow positive forever. Even in 2009 it took in $130 billion dollars more than it spent. So it’s had no impact at all on the public debt. (On government borrowing from Social Security and the implications for future liabilities, be patient; more below.)

Medicare gets part of its revenues from taxes, and part from government transfers. Those government transfers each year contribute to the annual deficits and cumulative debt.

Medicaid doesn’t have its own income stream; it’s all paid for off the general government budget, so it contributes directly to deficits and debt.

So let’s look at Medicare and Medicaid, because they’ve affected past deficits and public debt. Here’s the spreadsheet.

Medicare

I’ll only show hospital insurance (HI) and supplementary medical insurance (SMI) here, because obviously George Bush’s Part D drug insurance program didn’t have any effect on earlier budgets. (Though it’s had — and will have — mondo effects on budgets since it was enacted using intentionally false accounting by the Bush administration. Love those pharmas.)

Each program, as an independent entity, has a basic income statement — revenues minus expenditures. Simple. Based on their income statements, the two programs combined have been cash-flow positive in every year since 1996, with three exceptions (’82, ’95, and ’97). (For the curious: Each individually has also been generally cash-flow positive.)

So it might seem that they’ve actually contributed to the unified budget (SS and Medicare [etc.] combined with the general government budget) — reducing deficits and debt almost every year.

Except: part of those revenues are from taxes; they’re “General Revenue Transfers” from the government. Those are direct subsidies to pay for unfunded expenditures, cash transfers that will never be paid back to the government. Those transfers are part of the annual deficits, and they increase public debt.

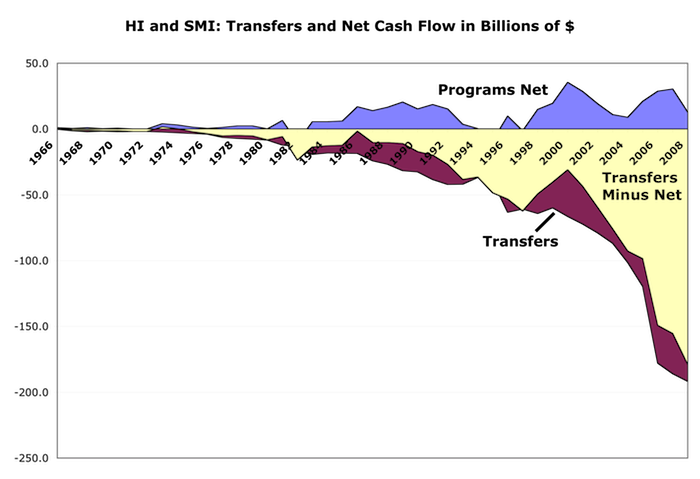

Here’s what that looks like:

You can argue about whether the transfer amount or that amount minus the programs’ nets should be used for our cash flow discussion. I think the nets should be included because they’re actual cash balances that can be used to pay for future Medicare expenses, so the government won’t have to make future transfers to cover that. But it doesn’t matter much because the two figures aren’t very different.

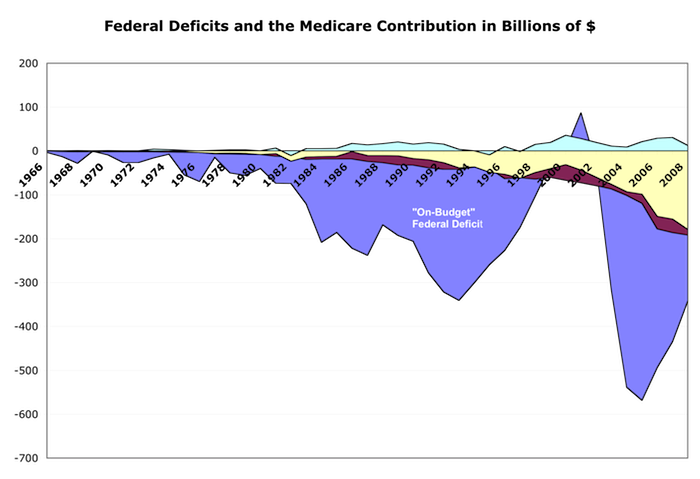

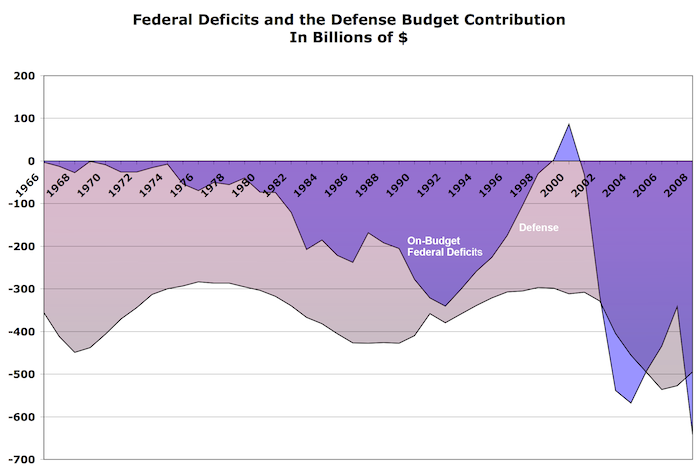

Whichever figure you use, the question we’re asking is how those Medicare costs compare to the federal deficits over past years. Here’s what that looks like:

Note that I’m being incredibly unfair to Medicare here, implying that all its transfers are assigned to increasing the deficit, but that the defense budget (for example) has no responsibility for the deficit.

It’s too bad I don’t have Medicare numbers for 2009 (tables 8.A1 and 8.A2 in the 2010 Statistical Supplement haven’t been published yet), because you’d see the deficit go spectacularly off the chart, while Medicare would only go up some.

The on-budget deficit is the one you need to use here, because we’re trying to see what Medicare actually costs the government each year, out of pocket. We’re already pulling those costs — the transfers from the (on-budget) government account to the off-budget Medicare account — out of the total deficit for comparison.

Medicaid

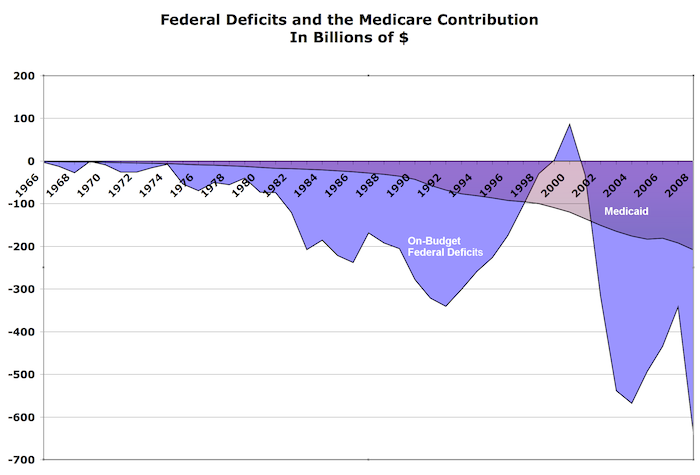

This program has no dedicated revenues. It’s all out-of-pocket for the government. (States have Medicaid trust funds, but that’s a whole other bundle of spaghetti.) Here’s what those expenditures look like (I just figured out how to do transparency in Excel!):

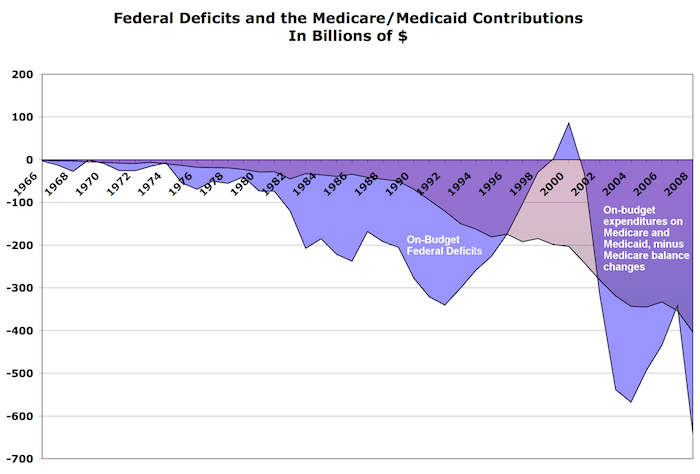

And here’s Medicaid and Medicare combined (including Medicare’s net for each year):

As you can see, prior to 1990, entitlements made up a pretty small share of deficits — and that’s assuming you post all those expenses against the deficit, instead of posting, say, the defense budget. Here’s what that looks like:

But let’s go with the underlying assumption — that the government shouldn’t have spent anything on health care for the poor and the elderly, and anything it did spend was just adding to deficits and debt. That’s a pretty huge assumption. But given that, here are the numbers:

| Increase in Debt | Medicare Share | Medicaid Share | Medicare % of Debt Increase | Combined % of Debt Increase | |

| Reagan (’81–’89) | 1,613 | 182 | 217 | 11% | 25% |

| Bush I (’89–’93) | 1,240 | 155 | 244 | 12% | 32% |

| Combined | 2,853 | 337 | 460 | 12% | 28% |

We can say this for certain: of the $1.6 trillion in debt added under Reagan, 75% had absolutely nothing to do with entitlements. He managed that via other means.

I realize that this is all history, and doesn’t address unfunded future entitlements. I’ve already bemoaned the fact that they’re unfunded because we didn’t pay the penny on the dollar to fund them over the last thirty eight years, but that’s not much help for the future. Everybody knows the rule of compounding returns: invest early. But since the Republicans wouldn’t allow us to do that, we’re going to have to raise taxes a lot more now than we would have otherwise.

Cause I got news for you: no matter how much the Tea Partiers wave their widdle flags, they don’t want to cut Medicare, Medicaid, or Social Security either.

Comments

3 responses to “The Republican Debt Binge: Was It the Democrats’ Fault?”

Minor correction: a page or two down, you list the revenue sources for the three programs, but you list Medicare twice when I think you meant Medicaid for one of them:

Social Security has been steadily cash-flow positive […]

Medicare gets part of its revenues from taxes […]

Medicare doesn’t have an income […]

@Harold Tessmann III

Thanks, Harold! Yes typo indeed. The third item is medicaid, as you suggested.

[…] […]