Bruce Wilder had an excellent comment recently in the Crooked Timber thread on markets, economic rents, and the constraints on economic actors, excerpted by Dan here, and more with comments by Jazzbumpah here. (If you like the thinking there, run don’t walk to read this windyanabasis post and comments.)

The emphasis on constraints prompts me to revisit a post I made a few years back, pointing out that constraints, not innovation, are the shaping forces of economies:

Lane Kenworthy’s Big Idea

Attributing the robust state of modern economies to the “free†market is like saying that Arabian stallions, champion Rottweilers, and freshly-picked sweet corn are the result of mutation.

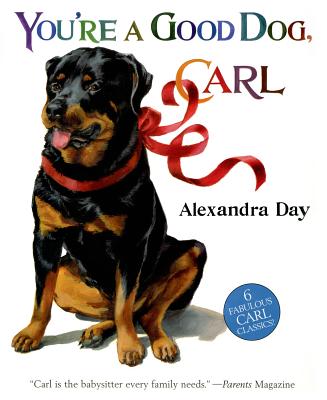

Would you and your family rather live with a wolf, or Good Dog Carl?

That’s the thought I come away with after reading Lane Kenworthy‘s chapter on “The Efficiency of Constraints†in his book In Search of National Economic Success: Balancing Competition and Cooperation (1995).

After quoting Smith’s seminal “invisible hand†passage, Kenworthy says (emphasis mine):

The reason actors engage in economically beneficial behavior, according to the [neoclassical] theory, is not that they have unlimited freedom of choice, but that they must choose within a particular set of constraints — the constraints imposed by market competition. … It is this constraint, rather than freedom of choice, that is the crucial efficiency-generating mechanism in a capitalist economy.

In other words, extolling the “free†part of free markets is like getting all drippy about mutation without selection. More Kenworthy:

The issue is not free choice versus constraints, but what type of constraints produce economically productive activity.

Natural selection — in this case the constraints imposed by the natural and human environment and by other free-market agents — is a powerful force. But Kenworthy asks, quite reasonably, whether it is always more efficiency-producing than artificial selection (a.k.a. human-directed selection, a.k.a….breeding). In many cases, the visible hand of government creates more efficient markets.

Free-market advocates tend to ignore the reality that market-generated constraints often act directly against the formation of efficient markets. To choose what is perhaps the most obvious example: competition creates huge incentives for market participants to make sure that all information is not known. Disclosure regulations address that inefficiency, and result in the kind of robust open markets we see today in prosperous countries. Kenworthy gives three more (detailed and well-analyzed) examples in his chapter.

Even Adam Smith doesn’t assert that market constraints have some a priori claim to superiority. Says Kenworthy, quoting Smith,

…an individual who “intends only his own gain†is “led by an invsible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it.â€

“Nor is it always.†“Frequently.†Cherry-picked, at least, it verges on a mealy-mouthed endorsement. Smith, in his wisdom, is not nearly so categorical as his latter-day disciples.

Kenworthy’s attention to constraints — market-imposed and otherwise — strikes me as a profound insight, cutting straight to the heart of the laissez faire philosophy of neoclassical economics. But the idea — at least in this form — has not been taken up much by mainstream economists. A notable exception is Kenworthy’s colleague Wolfgang Streeck (who Kenworthy credits with inspiring his chapter in the first place).*

Not surprisingly, Kenworthy has a lot more than one good idea. National Economic Success has a boatload. Ditto his latest, Egalitarian Capitalism: Jobs, Income and Growth in Affluent Countries (2007). This post is already altogether too long, so I’ll leave it to other posts — and other posters — to delve into those ideas.

* “Beneficial Constraints: On the Economic Limits of Rational Voluntarism.†In Contemporary capitalism: the embeddedness of institutions, ed. von J. Rogers Hollingsworth.

Cross-posted at Angry Bear.

Comments

One response to “Innovation and Market Constraints: The Case for Artificial Selection”

[…] Cross-posted at Asymptosis. […]