What caused the Great Depression? What caused the current…whatever it is?

According to James Livingston, the roots of both lie in shares of income. When not enough people are getting not enough wages and salaries–and when a large share of income is derived from financial investments, not work–we’re in bubble land, and things fall apart.

(My explanation: because income is not widely distributed, aggregate demand cannot support productive industry, hence there are not enough productive investments available, hence financial assets seek out imaginary returns. We know the result.)

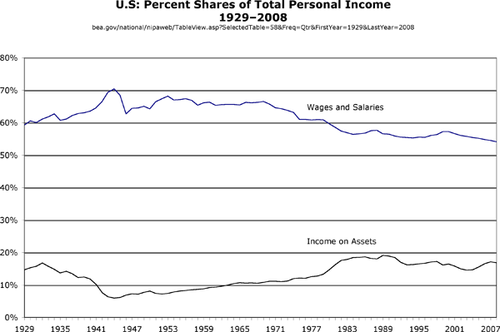

Here’s what that picture looks like (BEA; data here):

The story this mirror-image picture tells: In 1929, the percent of income received in wages and salaries was at a historic low (see below for 1920s data). There was a strong (and volatile) correction during the Depression and war/post-war years, followed by a long period of stable and historic highs during The Great Prosperity.

Those highs started declining in the seventies, continued down under the sway of Reaganomics, and fell even further under Bush II. By 2008, wage-and-salary share had reached profoundly historic lows.

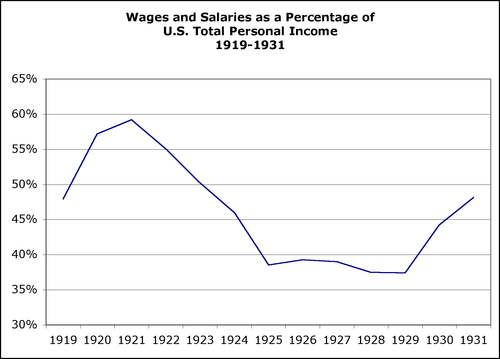

Did we see the same type of decline pre-1929? Yes–even more so. The BEA time series doesn’t extend before 1929, and I haven’t found a comparable/contiguous series going farther back. But we can get a picture of the 1920s from tax return data. (Large scanned PDFs here [Table 196 p. 203] and here [Table 173 p. 173]). Here’s what that picture looks like:

By this measure, in just a few years the wages-and-salaries share of personal income plummeted from the 50/60% range to less than 40%. ’25 to ’29 represented a truly profound historic low. (Wage-and-salaries’ share snapped back after the crash, of course, because financial profits constituted a proportionally much smaller share of income.)

What about this time? It took a long time for those decades of decline to achieve their ill effects. There are many plausible explanations for this. Here are a few.

• The Fed got a lot more competent at managing the economy’s volatility.

• There was much wider participation in the housing/asset markets/bubbles–maintaining the illusion was a larger group effort.

• Consumer credit became ever-more widely available, temporarily counteracting the declining/stagnating income share.

• Increasing government redistribution (15% of total income in 2008, up from 3% in 1945 and 9% in 1970) buoyed aggregate demand by giving people money to spend even while wage-and-salary share declined.

But the fact remains: both crashes occurred at a time of historically low ebbs in wage/salaries’ share of total income.

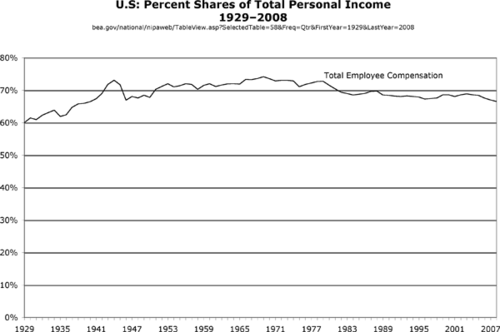

Caveat: It must be admitted that total employee compensation (including benefits and employers’ social insurance expenditures) has not shown quite as clear a picture as have wages/salaries alone:

Total compensation in 2008 was nowhere near the lows of 1929 (when there was no Social Security and benefits were quite limited). But even with those huge benefit boosts, it had declined to a level not seen since the ’40s–well below the level that prevailed during the Great Prosperity.

This is perfectly in keeping with both a common-sense and an empirical behavioral view of economic incentives. The actual dollars people receive in their paychecks (and/or their transfer payments) every week or two provide them with a far more moving (if short-term) gauge and incentive than the uncertain, rarely perused, and long-deferred benefits that are (only implicitly) promised in boxes 4 and 6 of their annual W-2s.

When people are taking home good money from their paychecks, they spend it on goods and services. That demand supports productive enterprises. That provides truly productive investment vehicles for financial assets. And so the log keeps rolling.

Comments

5 responses to “Want Prosperity and Stability? It’s About Wages and Salaries”

[…] been systematically excluded from neoclassical theorizing, which very issues might be the primary cause of financial cycles (at least the big ones, the long-term […]

[…] Here’s another look at it, from a couple of years back. (function() {var s = document.createElement('SCRIPT'), s1 = document.getElementsByTagName('SCRIPT')[0];s.type = 'text/javascript';s.async = true;s.src = 'http://widgets.digg.com/buttons.js';s1.parentNode.insertBefore(s, s1);})(); […]

[…] even among progressive economists. Viz, this from Paul Krugman back in December, 2008, when the highest inequality since The Great Depression was was in the process of delivering the first (at least potential) depression since…The […]

[…] even among progressive economists. Viz, this from Paul Krugman back in December, 2008, when the highest inequality since The Great Depression was was in the process of delivering the first (at least potential) depression since…The […]

[…] (the Federal Reserve doesn’t start tracking the wage share independently until after WWII). Those numbers sync up with this […]