I’m rather terrified to find that Brad DeLong has replied to my recent post on this subject.

I would expect greater inequality coupled with a higher propensity to save on the part of the rich to drive all asset yields down. Yet what we have seen has been a steep, prolonged fall in Treasury bond yields while stock-market equity yields have plateaued at about 5%/year:

To reply to this specifically: I would point out that the conversation going around is about SecStag post-1980. And we did see a “steep, prolonged fall” in equity yields over that period.

Why did it stop at 5% while Treasuries hit the floor? I’d suggest a pretty simple explanation: it’s because many/most financial investors evaluate “risk” based on historical price volatility including Sharpe ratios and the like (arguably inappropriately, but nevertheless). Equity prices are historically more volatile than Treasury prices, so investors demand a minimum yield in return for that (perceived) risk. Since they measure that volatility looking back over many decades, the risk perception doesn’t change much. There’s a floor. If they can’t get that minimum return for perceived risk, they’ll just buy bonds — especially Treasuries, which have zero risk if held to term.

So basically, I don’t think post-1990 equity yields tell us much about the secular stagnation story.

There are, though, a lot of good stories explaining how extreme wealth concentration and the (true) truism of declining MPC in a high-productivity, affluent economy could deliver the secular stagnation symptoms we’ve seen over recent years and decades. As usual, Steve Randy Waldman tells one of the best stories, and tells it best. Really, read the whole bloody thing, it’s brilliant as usual, impossible to choose what to excerpt.

I told a story here, as well. It’s only a partial story, but it emphasizes what I think is a key driver: the turnover, velocity of financial assets: wealth.

Paul Krugman’s response to Steve’s post points out where I think even liberal and saltwater mainstream economists are off the tracks.

…any such story, basically an underconsumptionist story, would seem to depend on the notion that rising inequality has led to rising savings. And you just don’t see that. Here’s private saving as a share of GDP:

Obviously it jumped up after the housing bust, but until then it was actually declining, and even now it’s below historic highs. I just don’t see how to make the underconsumption story work.

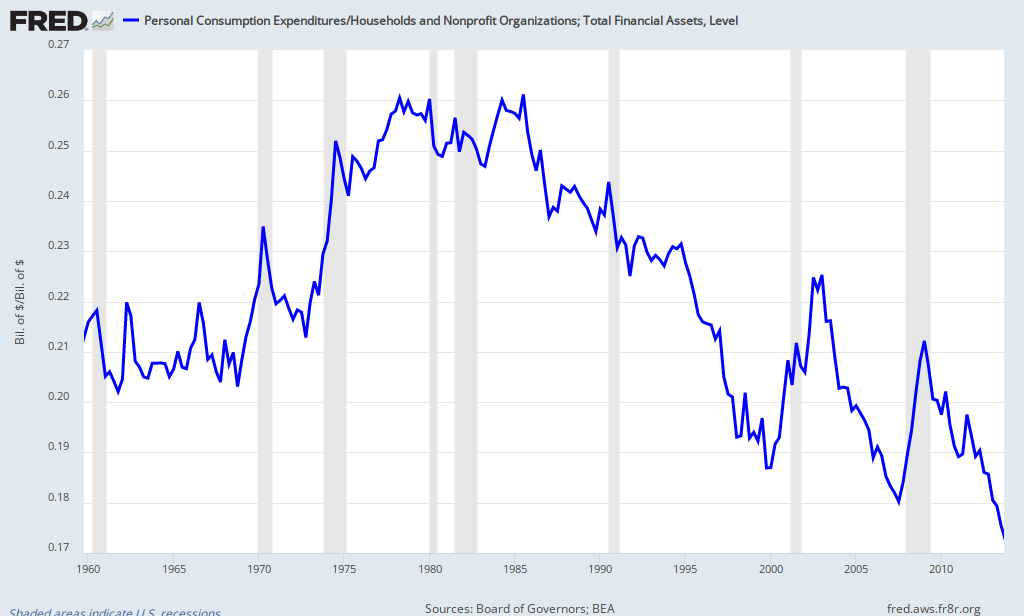

I want to suggest that this is not the best measure to be looking at, for many reasons theoretical and empirical that I won’t burden you with here. Rather, look at spending (aka not-saving) relative to the stock of financial assets (“money”).

Here, Personal Consumption Expenditures as a percent of Household Financial Assets:

You could use many other, different measures to flesh out this picture, but the picture’s pretty clear. People are turning over their wealth much more slowly.

I think this picture is very much in keeping with the notion that increasing wealth concentration and people’s declining marginal propensity to spend out of wealth results in less spending (relative to a more-equal counterfactual), hence less production, less surplus, less accumulation, and less saving. Less GDP. Less prosperity. And far less aggregate utility. Stagnation.

I find this wealth-turnover/velocity story especially compelling because the upward redistribution and increasing concentration of wealth over recent decades has been utterly off the charts, completely dwarfing the already eye-popping increase in income concentration.

Cross-posted at Angry Bear.

Comments

5 responses to “Wealth Concentration and Secular Stagnation”

Good work Steve…

[…] Update: Brad DeLong has replied, and I have replied to him. […]

[…] Update: Brad DeLong has replied, and I have replied to him. […]

[…] Replying to me, two days ago: I would expect greater inequality coupled with a higher propensity to save on the part of the rich to drive all asset yields down. Yet what we have seen has been a steep, prolonged fall in Treasury bond yields while stock-market equity yields have plateaued at about 5%/year. (I replied to this here.) […]

[…] mid-December, with some of my favorite commenters going after the underconsumption argument that I’ve been going on […]